Make grain great again

This week Obama is out, and Trump is officially in.

The world will be watching as the new ‘leader of the

free world’ takes office, and whether he will still be

moving the markets through his twitter account.

The market is looking forward to the 2017/18 harvest,

and wondering how the global wheat crop will look

for next year. Will plantings be down?

The futures market had a strong rally since the USDA

set their forecasts for the US winter wheat planting

at the lowest level since 1909, however the reality

has crept back into the market that global end stocks

are still record high. Although US plantings of wheat

are expected to be reduced, it is expected by the

International Grain Council (IGC) that the rest of

the world will largely be unchanged. The IGC point

to favourable conditions in the northern hemisphere

resulting in a predicted 17/18 crop of around 735mmt,

and the third largest on record. We have to remind

that forecasts at this time of year are open to large

margins of error, yet the market has responded with

falls overnight (figure 1).

At a local level it will not be a surprise to anyone

reading Mecardo updates over the past year that the

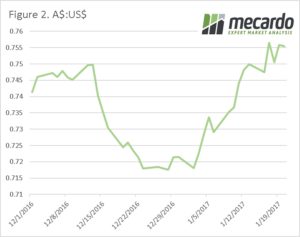

size of the harvest is pressuring basis. In table 1,

we have shown basis levels across a number of ports.

The general trend is that basis is slipping across all

ports, the most exceptional is Port Lincoln which

has steadily fallen into negative territory. In

Kwinana basis is still strong, however looking back

at December levels were greater than $50.

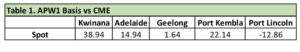

All eyes in the coming weeks will be on President-elect Trump,

with a wide degree of volatility expected.

This has already been seen with traders dumping the

US$ (figure 2) despite comments from federal reserve

pointing towards interest rate rises in the coming

weeks. Overnight Trump appointed George Perdue

as the secretary for agriculture. Perdue is the first

agriculture secretary since 1994 from out with the

Midwest, but has a wide range of experience within

the grain and livestock industries.

The Week Ahead

The inauguration will be held at 3am east Australian

time on Saturday morning, I will probably be up at

that time watching it thanks to a sleepless newborn.

There are a lot of contrary views when it comes to

Trump and regardless of your view of him his election

has produced a lot of energy. In the coming months,

we will get a strong view of whether candidate Trump

is the same as President Trump. One of the risks in

markets which is always extremely difficult to predict

is political, and we could see black swan events in the

coming months, and that is before we look at the

coming EU elections.

The world continues to be awash with wheat, and barring

any major weather event in the next 6-8 months, prices

will remain low. In the last four seasons the global crop

has largely made it through without any major hiccups –

can we get a “five-peat”?