Market plummets

The stable market reported last week vanished quickly in sales this week as buyer confidence evaporated. Border closures in India & Italy, along with difficulties obtaining finance during this difficult time caused buyers to dramatically reduce buying limits. By weeks’ end, the EMI recorded its largest fall in percentage terms since May 2003.

Last week buyers reacted to concerns about supply and the risk that sales would be closed, this now appears a premature move. This week it was the concerns about consumer confidence and the lack of orders from retailers for next northern hemisphere winter coming forward.

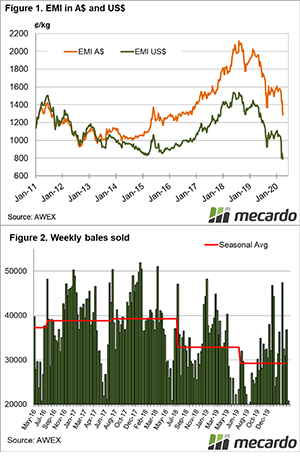

The Eastern Market Indicator (EMI) lost 97 cents on the first day of selling, with a further 58 cents on the final day to close at 1,287 cents, a loss for the week of 155 cents. The Australian dollar contributed to the carnage, rising 2.09 US cents to be quoted on Thursday at US$0.613. This cushioned buyers to some degree, with the EMI in US terms down 65 cents to 789 cents.

The Western Market Indicator followed suit, retreating 159 cents to close at 1,353 cents.

Of the original roster, 16.6% was withdrawn prior to sale by growers, this produced a reduced offering compared to last week of 37,713 bales. The pass-in rate surged to 44.9% nationally leaving just 20,780 bales cleared to the trade. This was 16,000 fewer than last week.

Sales are running 200,000 bales behind the same period last season, or just shy of 6,000 bales per week fewer.

This week the total sales value was $28.33 million (down $27 Million on last week) or $1,363 per bale also down $140 per bale compared to last week.

Crossbred types were not spared, losing 100 cents plus across all indicators, despite growers passing-in more than 50% after significant volume was withdrawn pre-sale.

The strong crossbred types were friendless, with the 32 MPG slumping 109 cents to 300 cents, the lowest level since 2008. Cardings lost 88, 152 & 74 cents in Sydney, Melbourne and Fremantle respectively.

The week ahead

Sellers remain keen to get wool to sale with 44,216 bales listed for next week and all centres again selling on Tuesday & Wednesday only.

What happens next week in the market is anyone’s guess, confidence is shot from the buyer perspective, however, it is assured that the 44,000 bales currently rostered won’t all be sold.