Market says “no”!

The question last week was “is this the bottom?” We had a clear answer this week,in the short term the market pain is still coming. Again a small offering was met with a lack of confidence (read lack of orders) from buyers and their processor customers; this resulted in the market reaching its lowest point since December 2017.

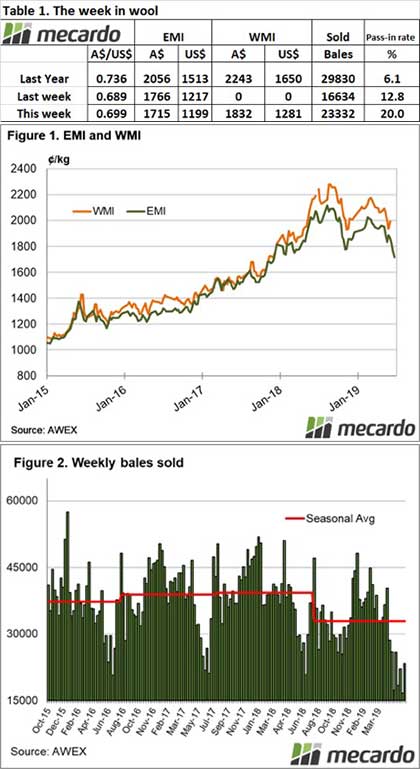

The Eastern Market Indicator (EMI) shaved off nearly 3% to close the week at 1715¢/kg clean. A higher Australian dollar limited the market falls in US$ terms with the US$ EMI only easing 1.5%. The improving Australian dollar value seemingly adding to offshore buyer disinterest in our wool this week despite the relatively low offering.

AWEX report that the EMI has lost 172 cents in June; this has only been surpassed in March 1991 when the Reserve Price Scheme was abolished. In percentage terms, the EMI has retreated 9.1%, the largest fall since August 2012.

29,167 bales were offered at Sydney, Melbourne & Fremantle, almost 10,000 more than last week with W.A. back in the market. The pass in rate across the selling centres jumped to 20.0% for the week, well up on last week’s 12.8%. Fremantle passed in 1 in 3 bales offered, this meant that 23,332 bales were cleared to the trade, 6,500 fewer than the corresponding week last year.

Crossbreds also recorded falls, although not to the full extent as the Merino section, losses of 30 to 50 cents was common.

This week marked the final trading session for the 2018/19 season and an assessment of the offering during this season shows that bales offered have declined nearly 12% on the volumes offered during the 2017/18 selling season. A falling market on reduced supply can only signal one thing, weaker demand.

Certainly reports from wool exporters suggest the ongoing trade issues between China and the US have impacted consumer sentiment within the Chinese economy and have offshore wool buyers a bit spooked.

The week ahead

Next week a combined offering of just over 34,500 bales is rostered across all selling centres, with a further 35,000 the following week before the winter recess.

AWEX make the point that the first sale in the new financial year is usually a larger one with growers clearing wool held over, however the current roster is well down on the same period last year, where over 37,000 bales were acrtually sold in each of the first 2 sales.