No news is good news.

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season.

At a time when the live sheep export trade is making headlines for all the wrong reasons the big brother of the industry is quietly getting on with the job. Live cattle exports make up the lion’s share of the total trade out of Australia, with the combined beef and dairy trade representing 1.5 billion of the 1.8 billion annual farm gate returns. This piece takes a quick look at how the key markets are faring so far this season.

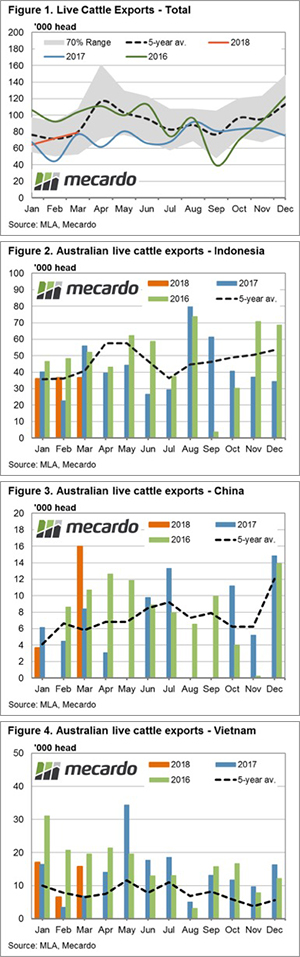

A look at the current seasonal pattern shows that total live cattle exports for the first quarter of 2018 have pretty much been on the five-year average trend after a slow start in January – Figure 1. Average monthly trade volumes across the first quarter of 2018 sit just 5% below the five-year first quarter average, but is 14% higher than the average monthly volumes set during the first quarter of 2017.

The trade to Indonesia dominates the market share and it is currently sitting at 50% of the 2018 total live export volumes. This is despite the first quarter of the season averaging 3% below the five-year seasonal pattern at around 36,000 head per month – Figure 2.

The flow of live cattle to China has been more erratic than the Indonesian experience so far this year. After an average start to 2018, February saw nothing delivered and then March followed up with the biggest monthly figure reported since the middle of 2015 at just under 16,000 head – Figure 3. Indeed, this is the largest March flow on record from Australia to China and represents a 175% increase on the five-year average pattern for March.

Average monthly consignments to China for the first quarter of 2018 are running 19% above the seasonal five-year trend and sit 3.5% higher than during 2017, a good sign of continued growth in the demand from China – which currently comprises about 9% of the market share of the trade out of Australia.

Vietnam holds the second spot in terms of market share of Australian live cattle exports, with the percentage of the trade so far this season sitting at around 18% of total flows. The first quarter of 2018 has begun in a reasonably solid fashion with average monthly volumes over the period sitting 61% above the five-year seasonal pattern monthly average levels – Figure 3.

What does it mean?

Seasonal movements of total live cattle flows show that during April and December there is often a peak in trade volumes as consignments to Indonesia commonly increase during this time. Domestic cattle prices are broadly softer and the Australian dollar has been trending lower since the January 2018 peak above 81US¢, which should assist the competitiveness of live cattle into the peak part of the season.

Combined with the strong start to the year out of Vietnam and China, it is something positive to look forward to for live export participants enduring a bit of a delicate time at the moment.