Oil be damned

May you live in interesting times. A phrase which absolutely applies to 2020. As well as Coronavirus, we are also an ‘oil war’ between OPEC nations. This has resulted in big moves in the oil industry.

The oil market was falling in recent weeks due to demand disruption caused by reduced trade and drastically falling passenger numbers on air travel. However, instead of curtailing supply the major producers have done the opposite!

The Organization of the Petroleum Exporting Countries (OPEC) had planned to reduce output in order to stimulate prices. However, Russia was unwilling to agree to plan. In response, Saudi Arabia threatened to flood the market with oil.

As the worlds largest exporter this represented a huge risk to pricing as with lower extraction costs (US$8.98), they can sustain very low oil prices for extended periods.

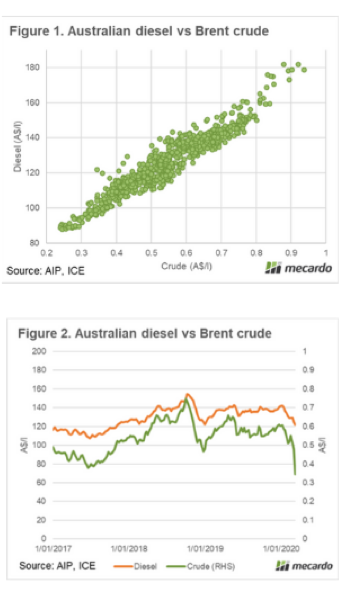

Diesel is derived from crude oil, and any changes to the price of crude will flow to our fuel prices within Australia. When converted to Australian dollars/litre the correlation between crude and local diesel is 0.95, with 0 being no correlation and 1 being a perfect correlation. This can be seen in figure 1.

In figure 2 both crude and oil are displayed in A$/litre. The crude oil price has been creeping down since the start of the coronavirus crisis, however, has seen its largest fall in over a decade in the past week.

Diesel prices have been falling this gradual decline to reach the lowest levels since last January.

What does it mean/next week?:

At a time of low demand for oil, the oil-producing companies have gone against logic and are increasing supply.

Crude oil prices have been absolutely smashed. There is a lag between the fall in crude and diesel prices, however, we would expect that prices will fall further throughout the week if crude remains at current levels.

This is good for my 120km daily commute, but will also be good for those preparing for seeding.