Pandemics and wool prices

The 2019 Novel Coronavirus (2019-nCoV) is causing ructions in various markets as the Chinese and associated economies are disrupted by the efforts to limit the spread of this new virus. This article takes a look at recent pandemics and their effect on wool prices.

2019-nCoV (2019 Novel Coronavirus) is the third coronavirus of the past two decades. It was preceded by SARS in 2002-2003 and MERS in 2014. In between, there was the H1N1 flu pandemic of 2009-2010.

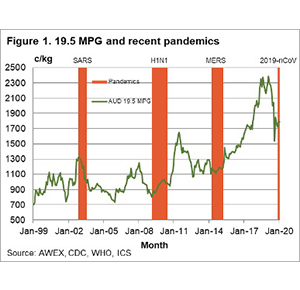

Figure 1 shows the 19.5 MPG from 1999 to last week with the periods when pandemics were present. On the surface, the price reaction to SARS looks ominous with price falling by 28% in early 2003 (in US dollar terms the fall was 20%). The next two pandemics (H1N1 and MERS) happened when prices were near cyclical lows and did not seem to have any great effect.

SARS (https://www.cdc.gov/sars/ ) was first reported in China in early 2003. It ran to mid-2003 with a mortality of 774 people. It would be fair to say that the current outbreak of 2019-nCoV (also starting in China) is being treated with a far more robust response by the Chinese government. This response, which includes cancelling Lunar New Year festivities, extending the Lunar New Year holiday, locking down large areas and restricting travel, will disrupt the Chinese economy and other economic areas associated with China such as Australian universities which have a high proportion of students from China.

In 2014 MERS (a coronavirus) appeared in the Arabian peninsula, with an ultimate mortality level of 858 people.

In 2009 the H1N1 virus (https://www.cdc.gov/flu/pandemic-resources/2009-h1n1-pandemic.html ) began in Mexico. In Figure 1 it is associated with a small rise in the 19.5 MPG. The H1N1 virus killed 20 times as many people (verified) as SARS, with estimates of worldwide deaths ranging between 150,000 and 575,000. H1N1 dwarfed SARS in terms of mortality, but hardly registered in terms of wool price. This seems to confirm the view that it is the response measures (such as is going on in China presently), which impact on wool demand rather than the actual mortality levels.

The exception to the above view is if 2019-nCoV turned out to be another Spanish Flu (1918-1920) https://www.cdc.gov/flu/pandemic-resources/1918-pandemic-h1n1.html where one-third of the world’s population was assessed as being infected with 10% of these people dying. This was the worst pandemic of the 20th century. That is what drives the various health authorities around the world to contain 2019-nCoV as much as possible.

What does this mean?

In cold-blooded terms the economic effect of recent pandemics has not been related to the mortality levels, but rather to the disruption caused by measures designed to limit the spread of the pandemics. The current coronavirus is centred in China which is a critical manufacturing centre for the world economy. Strenuous efforts by China to limit the spread of 2019-nCoV (much more so than for SARS) seem likely to cause some short term disruption to demand for imports such as greasy wool hence reducing demand and price.