Positive note short-lived

The modest gains posted last week proved short-lived. The opening day in Melbourne provided some optimism but the market was unable to maintain the early price improvement to eventually end on a disappointing note.

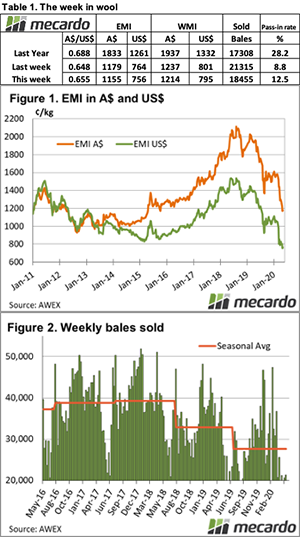

The Eastern Market Indicator (EMI) fell by 24¢ this week to close at 1,155¢. The Australian dollar was up 0.73¢ to US$0.655, which cushioned the EMI in US$ terms, only falling by 7 cents to 756¢. The Western Market Indicator also fell, losing 23¢ to close at 1,214¢.

Turnover this week was down marginally at $23.76 million or $1,287 per bale, taking the season to date value to $1,856 million.

The pass-in rate was up marginally on last week to sit at 12.5%, after growers withdrew 8.6% of the offered bales pre-sale. This resulted in 18,455 bales clearing, just on 3,000 fewer than last week.

While the season to date weekly average sale clearance is at 27,595 bales (34,400 same period last year), the past 10 weeks has seen the clearance volume slip to an average of 22,600.

Supply is remaining constrained as growers wait and hold wool, with the expectation (hope?) that prices will recover soon. Many are supported by recent high price sales of clips over the past 2-3 years, as well as strong sheepmeat sales. However, this can only last for so long. We are now seeing growers increasingly concerned about the short and medium-term outlook for prices.

The falls were spread mainly across the Merino MPG’s with 8 to 64 cents falls reported, in fact, the EMI would have reported a larger fall if not for the fact that the Crossbred section remained unchanged.

Nationally just 2,342 bales of Crossbred designated wool was offered with 2,070 selling, with the Cardings section also clearing a modest 2,100 bales. This reduced offering pushed the Cardings indicators up in all centres, with an average 28¢ lift.

The week ahead

Next week’s national offering is a slightly smaller offering of 20,359 bales with Sydney & Melbourne selling on Tuesday, while Melbourne & Fremantle will offer on Wednesday.

To say we are in unchartered waters is an understatement, with a buying trade operating under severe limitations.