Prediction is very difficult, especially if it’s about the future.

The rainfall and production prospects for the coming year are an unknown, will it be colossal or dreadful? The reality is that no-one really predict weather out 12 months with any degree of accuracy – not even astrologists. In this article we look at the ASX contract and whether it provides an opportunity for the coming season considering the drought premiums in the market at present.

The January ASX contract typically receives the highest level of attention, this is due to it aligning with the east coast harvest. The ASX contract could be a potentially fantastic risk management tool for producers and consumers, however liquidity has been an issue.

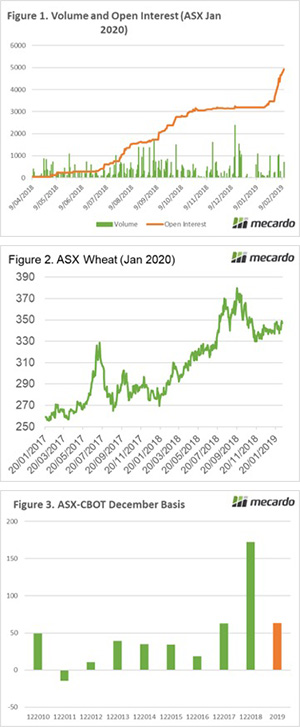

The January 2019 contract expired last month at a very attractive (for producers) A$434 due to the sustained drought through the past year. Since the contract expired, the open interest in January 2020 has increased dramatically (figure 1).

There have been many consumers who have experienced historically high procurement costs who are seeing the current pricing levels for next year as being high; but lower than last year.

In September, I pointed towards selling ASX for Jan 2020 as being a solid strategy (see here). The market at that point was in the A$369-374 range. The market then fell to A$330, which would have provided an on paper profit of A$39-44/mt. At the time we advised this is an opportunity for growers to hedge their 2020 crop and for consumers to recoup some of the losses of this season.

The market has started to creep up as consumers attempt to gain some cover for the coming year and concerns related to soil moisture as we head into seeding. Since the start of February the contract has traded at an average of A$343 (figure 2).

In figure 3, the December basis between ASX and CBOT is displayed for the January contract. This chart represents both the old NSW contract and the east coast contract as they are analogous. It is clear the basis level received during harvest this season was an outlier. The premium over CBOT was A$172/mt, versus a decade average of A$26. At present the Jan 2020 contract is at A$63 over, which would be considered ‘mild’ drought pricing.

What does it mean/next week?:

As mentioned in the preamble to this article, no one knows what will happen over the rest of this year. We could receive a bountiful supply of rain and grow a record crop, conversely, we could have a season worse than the last.

The current pricing levels for Jan 2020 would be considered very strong (if you remove 2018). It is my view that marketing plans should be conducted in chunks and if >A$340 is the worst price you receive for the coming season – that’s not a bad end result.

Key Points

- The ASX has struggled with liquidity in recent years, however consumers are more readily accepting it as a risk management tool.

- Historically attractive prices are on offer for the 2019/20 harvest.