Restockers digging deep again

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it.

Analysis of the underlying saleyard data that is used to create the Eastern Young Cattle Indicator (EYCI) shows that optimism of restockers has been increasing during October as they appear more prepared to pay a premium to secure young cattle. This piece delves a bit deeper into the figures to see if the renewed restocker interest is part of the normal seasonal cycle or if there is something more behind it.

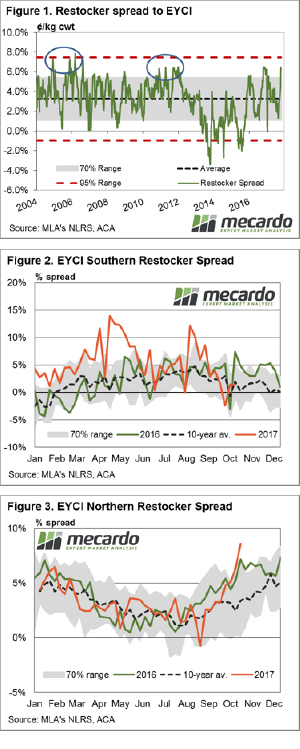

Figure 1 shows the historic movement in the restocker spread to the EYCI, with a lift in the premium percentage spread over October clearly evident. This effectively means that restocker buyers at the saleyard have been prepared to pay more to secure young cattle as the month progressed, indicative of increased buying confidence.

Indeed, the restocker spread has now broken above the 70% range banding for the first time since 2016 and currently sits at levels that have been characteristic of herd rebuild phases in the recent past, such as during 2011 and the 2005 seasons – as identified by the blue circles.

A further breakdown of the restocker figures into the southern and northern regions, with Dubbo as the halfway point, shows a distinct difference in the buying behaviour of northern and southern restockers, even after accounting for the normal seasonal differences in restocker spread activity.

Figure 2 outlines the restocker spread to the EYCI, filtered for southern buyers. Although there has been an increase in the spread from a discount to a premium over October it is still moving broadly in line with the normal seasonal pattern, as identified by the long-term average trend line and currently sits at a 1.4% premium to the EYCI.

In contrast, a look at the northern restocker spread activity over the season shows a significant improvement in the restocker spread during the September/October period. While it is not uncommon to see the northern restocker premium spread to the EYCI widen in the second half of the season the magnitude of the widening, particularly during October has been impressive when compared to the 2016 and longer term average seasonal pattern – figure 3.

Indeed, at a current premium spread of 8.6% the northern restocker spread is one and a half times the seasonal average and has broken above the usual range that is common for this time in the year, as identified by the 70% banding.

See related articles – July Restocker analysis & September Restocker analysis

What does this mean?

The July restocker analysis (see link above) suggested, the dry spell in Winter would see the restocker premium spread to the EYCI fall back to zero, in both the north and south – which occurred during September.

An updated forecast from the Bureau of Meteorology (BOM) pointing to the chance of a La Nina developing into late 2017/early 2018 has prompted the activation of a La Nina watch on the BOM website. The last La Nina event was recorded during the 2010/11 season which coincided with a herd rebuild phase that saw herd numbers rise 6.6% in 2011.

Clearly, the recent northern rains (with areas around Bundaberg reportedly getting up to seven times their monthly average rainfall during October) and the increased chance of a La Nina event on the cards have given northern restockers the confidence boost needed to get them back into the young cattle market in a big way. Let’s see how long it can last.