Should we be selling new crop wheat?

It’s too early to call the season, with the majority yet to sow their first seeds for the year. In this update I examine pricing for the new season. Should producers be selling wheat at these levels?

This season has been astronomical in terms of price with the market reaching historic highs across most zones in October. Although most of the benefit has been felt by producers in Western Australia who have had a very strong year in terms of production.

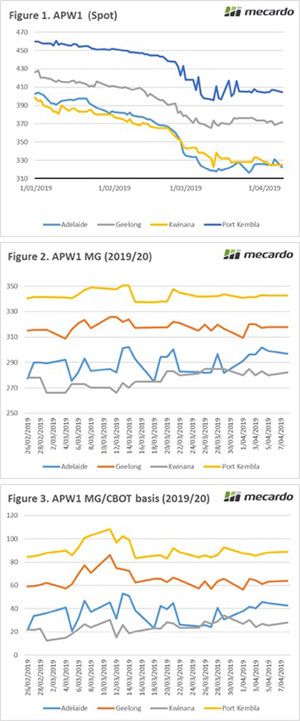

The spot market has fallen from these peaks since the start of the year (figure 1). At present pricing has found its floor, as consumers purchase hand to mouth. The only supply available will be from Western Australia until the new crop. This is likely to keep prices around this level until the new crop arrives.

The question now really remains – when we get to new crop, the price will be dependent upon the rainfall from here on in.

At present however, prices are still reasonably strong for new crop (figure 2). This is due to the great uncertainty when it comes to the crop. Currently subsoil moisture is low, and the pantry will likely be empty by harvest. As time counts down to harvest the new crop and old crop will converge, if conditions don’t improve then the price will converge upwards to meet old crop pricing. Conversely the opposite will happen if the conditions improve.

The price premium for spot over new crop currently sits at the following:

- Adelaide 11%

- Geelong 17%

- Kwinana 14%

- Port Kembla 17%

- Port Lincoln 15%

This shows up in the basis levels versus the CBOT Dec’19 contract. At present the Dec’19 contract is at A$253/mt. This results in attractive basis levels on the east coast ports (figure 3), especially if recent drought premiums are excluded.

What does it mean/next week?:

I have always tended to advocate a conservative ‘small bite’ selling strategy for producers. Locking small proportions over time dependent upon price, with a view to aiming for an average to above average price.

At present prices on offer for the 2019/20 harvest are historically attractive, and they do offer some value in selling

If the season becomes bleak that price might not be attractive, whilst conversely it could become your best. It’s all about minimizing exposure at this point of the year.

This also applies in the same way to consumers of grain, purchasing at these levels removes exposure to >$400/mt values if a second year of drought eventuates.

Key Points

- Old crop trades at a substantial premium to new crop.

- Basis levels are quite strong for new crop vs Dec’19 Chicago wheat futures.