Some positive signs amid the turmoil

The last week has seen some good news on the export front, with increasing volume to China, and some bad news, with the suspension of some plants. The news from the US was more positive this week, and while it’s not responsible for local price rises, it helps.

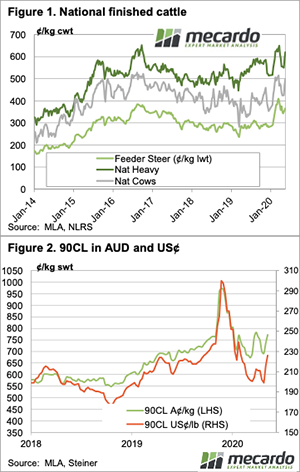

Despite the suspension of four beef processors from exporting to China this week, prices managed to gain ground. The Heavy Steer was the star performer, with the CV-19 National Indicator gaining 15¢/kg lwt, to get back to 335¢/kg. This week’s move puts the Heavy Steer back within 10¢ of the all-time record set back in March.

Cows and Feeders also gained ground, although they weren’t quite as strong (Figure 1). Tightening supply is no doubt helping prices higher, both at saleyard and over the hooks level, but improving export prices are playing a part.

Figure 2 shows the 90CL Indicator has lifted in both US and AUD terms (Figure 2). Steiner report that many US users are short stock, as they took a wait and see approach in April, and now need to stock up. Additionally, US Cow slaughter has been down, as with all cattle, and lean beef in general is in short supply.

The backlog of overfed cattle in the US might see continued lower Cow slaughter and provide some support for our exports over the medium term.

Despite the cattle backlog, US Live Cattle Futures bounced higher this week, moving back its highest level since mid-March. More positive signs of some resilience of beef and cattle demand.

Next Week.

It is hard to see cattle supply improving as we move toward winter. In fact, it should get tighter. Stronger export prices will be required to see prices keep rising in a similar trend to the last couple of weeks.