Southern cattle should start to get (more) expensive

The last week in January, or the first week in February, is usually the time when southern cattle reach their annual price low-point, relative to northern markets and the Eastern Young Cattle Indicator (EYCI). Recent price mov ements suggest this will again be the case, so what does this mean for pricing over the coming months.

ements suggest this will again be the case, so what does this mean for pricing over the coming months.

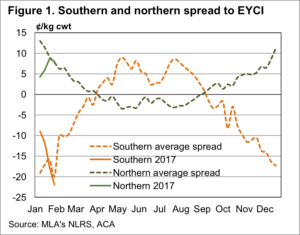

Figure 1 shows that since early January we have seen a sharp correction in the relative prices of young cattle in EYCI saleyards south of Dubbo. The discount for young cattle in the south has widened from 10¢ in early January, to just move past the 10 year average, and sit at 22¢.

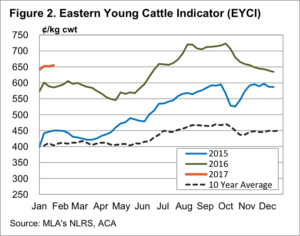

Young cattle prices in yards south of Dubbo haven’t actually changed, but the EYCI has gained 15¢, driven by a 19¢ appreciation in yards north of Dubbo, hence those in the south have become relatively ‘cheap’. This is despite absolute prices being at record levels of 633¢/kg cwt, for this time of year.

More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes.

More interesting is what happens from there with the southern spread to the EYCI. Over February, March and April, the southern discount becomes a premium, as the supply of grass finished cattle tightens, as grass supply wanes.

In the north the supply of finished cattle starts to improve in January, with the result being a weakening premium to the EYCI, bottoming out in May.

Figure 2 shows that the EYCI generally tracks sideways to slightly higher, in February and March. With the southern discount to the EYCI narrowing, to a steady or higher EYCI, this suggests we might see 20-30¢/kg cwt upside in southern young cattle prices in the coming month or two.

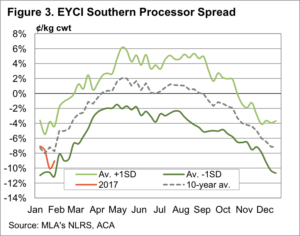

It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

It young cattle destined for slaughter, or trade steers and heifers, which are set to benefit the most over the coming months. Figure 3 shows that young cattle sold to processors improve 8% over the late summer and autumn. From the current level of 595¢/kg cwt, a narrowing of the discount to parity, would see the price reach 630-640¢/kg cwt. Prices haven’t been this good since October.

Key points:

- The southern cattle prices discount to the EYCI has fallen to its annual low point for the year.

- From the start of February southern young cattle prices generally improve 20-30¢ relative to the EYCI.

- Finished cattle have further to improve than restocker or feeder prices, and prices are unlikely to fall in the short term.

What does this mean?

Seasonality in cattle markets is driven by cattle supply, and the case of the southern discount to the EYCI is no different. Seasonality in this case is reliable, which suggests that young cattle in general, and trade steers and heifers in particular, are likely to improve in price over the coming month or two.

Whether it’s worth holding cattle to profit from this upside depends on the costs of carrying cattle through, and the direction of the EYCI.

In the north the decreasing premium to the EYCI is usually counteracted by a small improvement in the EYCI itself, and as such there it only the risk of cattle prices falling in general to discourage putting more weight on cattle.