Southern restockers starting to nibble at EYCI

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers?

A recent discussion with some livestock industry representatives this week suggested that in the southern regions, at least, restocker buyers were becoming more active. Certainly, the Eastern Young Cattle Indicator (EYCI) continues its grind higher closing at 532.5¢/kg cwt yesterday, up 1¢ on the week. But is it being supported across the eastern seaboard or by southern restockers?

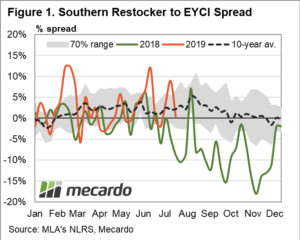

Analysis of the spread southern restockers are paying for EYCI eligible cattle up until the close of trading last Friday showed that southern restockers had been paying better than average premium spreads to the EYCI for the first few weeks of July, but it had narrowed to sit underneath the seasonal average trend in recent times – Figure 1.

Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season.

Indeed, as of last Friday the southern restocker spread to the EYCI sat at a premium of 0.5% prem compared to the five-year seasonal average for this time of the year at a premium of 2%. Not indicative of southern restockers becoming too enthusiastic about the market, but decidedly better than the 8.8% discount spread that they were paying at this time last season.

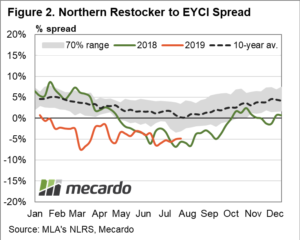

In contrast, Northern restockers are yet to really get involved this season with the spread to the EYCI as of last Fridays closing prices sitting at a 4.8% discount compared to a 0.2% premium spread as per the five-year average spread pattern, Figure 2. At least, as a consolation the northern restocker spread has moved above the trend set during the 2018 season, which was running at a 6.8% discount to the EYCI this time last year.

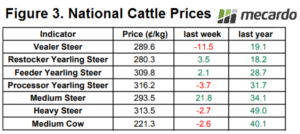

National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

National cattle prices at the sale yard reflecting the tepid restocker interest of late with Restocker Yearling Steer prices lifting 3.5¢ on the week to close at 280.3¢/kg lwt. Medium steer the big winner on the week across the national price averages posting a 21.8¢ gain to finish at 293.5¢/kg lwt – Figure 3.

Next week

Another week of limited rainfall is on the horizon. Coastal south western WA and southern Victorian regions are slated for 10-25 mm but not anything for where it’s really needed. This is going to continue to constrain restockers further north and put a cap on any price gains beyond what the tight winter supply scenario can offer.