Supply and price edging lower for lambs

Lower supply wasn’t enough to put a halt to the softening lamb prices this week, with what appears to be wavering demand. Small sheep numbers on the east coast however, did help to lift mutton prices.

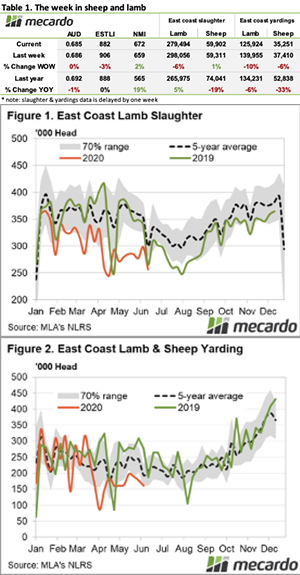

So far in June, east coast lamb slaughter has trended 12% below the five year average, and 4% below the tight supply year of 2011. The “tight supply getting tighter” situation continued last week with lamb slaughter down 6% on the week prior (Figure 1).

East coast sheep slaughter was steady for the week ending the 12th of June. 59,902 head were processed which was within the lower end of the 70% range for this time of the season.

Both lamb and sheep yardings were lower again, for a combined throughput of 161,175 head at east coast saleyards (Figure 2). This was 17% below the five year average level for this time in the season. The big drop came from NSW which saw 30% fewer lamb yardings last week compared to week earlier numbers.

Weaker lamb yardings was met with weaker prices. The Eastern States Trade Lamb Indicator lost 24¢ to come back under the magic 900¢ threshold, ending at 882¢/kg cwt. Trade lambs fared better in Western Australia, up 13 cents to 817¢/kg cwt.

Sheep continued to receive support, resulting in a 2% rise in the National Mutton Indicator on the week to close at 672¢/kg cwt.

Next week:

Declining supplies and softening prices is not a good sign for demand. We won’t sound the alarm yet, but the test will come in July when lamb supply starts to ramp up.