The best time to buy store lambs is….

Last week we looked at some long term trends in lamb and sheep trading enterprises. We identified that lamb trading margins were more reliable, but merino wether trading had the potential to offer very good margins, or on the rare occasion, losses. Price seasonality has a strong impact on trading margins so this week we delve deeper into the data looking for the best buy and sell months.

Our trade scenario is buying a 35kg lamb, holding for two months, and selling at 48kgs. No costs are accounted for, and as such the only variables are the store and trade lamb prices, and how these change over the two month term of the trade.

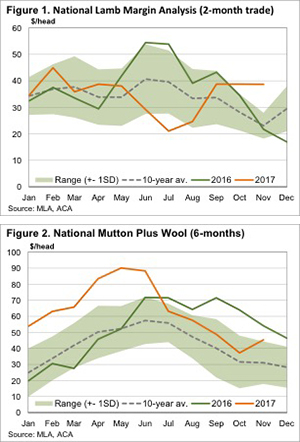

Figure 1 shows how the gross margins for the lamb trade have behaved over the last two years, and on average. The green shaded area shows the range of results two one standard deviation. The data points are for the sell months, so lamb purchases were made two months earlier.

Figure 1 shows how the gross margins for the lamb trade have behaved over the last two years, and on average. The green shaded area shows the range of results two one standard deviation. The data points are for the sell months, so lamb purchases were made two months earlier.

It would come as no surprise that on average November is the worst month to complete a lamb trade. The average gross margin for lambs bought in September and sold in November is $23/head, with a narrow range of $18-28/head.

The strongest months for trades would also give few surprises. June and July both average around $40/head thanks to strong seasonal price rises from April and May into the winter months. The ranges are wider for winter trades from $28-53/head, however, showing the price movements have less consistency than the spring falls.

This year abnormal seasons, and as such abnormal price trends have seen somewhat of a reversal in gross margins on lamb trades. There wouldn’t be many growers out there who would turn down a lamb trade paying $39/head for lambs sold in November, and those who took the punt have been well rewarded.

We can run the same seasonal analysis for our six month mutton trade, where merino wethers are taken from 50-62kgs, cutting 2kgs of clean 19 micron wool. Figure 2 shows that on average the best results are for wethers shorn and sold from April to July, but there is plenty of variation.

Key points:

- Gross margins on trading lambs and merino wethers shows strong seasonality.

- The best margins are on lambs and sheep sold in the winter, but these are also the most expensive to produce.

- Lamb and merino wethers bought now historically deliver strong margins, if costs can be kept under control.

What does this mean?

Sheep producers are likely to look at these charts and realise that the best gross margins are made at times when it’s hardest to turn off good sheep or lambs. Prices rise during times of shorter supply, due to the fact that grass has been hard to grow. These charts can be used when buying or holding sheep or lambs to quickly and easily assess upside and downside in any proposed trade, before some more in depth analysis is done.

For those looking at buying sheep or lambs, historical seasonality tells us that it’s a pretty good time to do it. Even the lower end of the historical range should provide a profitable trade for lambs and sheep, as long as feed costs are not too high.