The bottom for lamb or a dead cat bounce?

The lamb market was following the trend of the last few weeks, until rain and an out of the blue bounce upset the market yesterday. The Thursday rally was felt across the categories, but was it just a dead cat bounce?

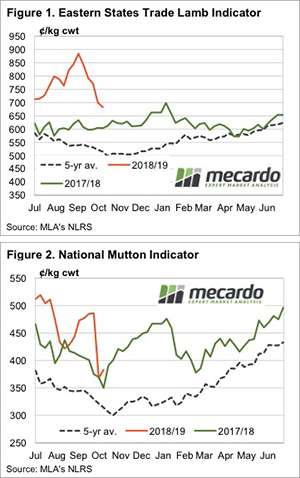

The market was moving along predictably enough. On Wednesday the Eastern States Trade Lamb Indicator (ESTLI) was down 57¢, hitting a 3 month low to 676¢/kg cwt.

The market was moving along predictably enough. On Wednesday the Eastern States Trade Lamb Indicator (ESTLI) was down 57¢, hitting a 3 month low to 676¢/kg cwt.

Yesterday at Wagga the market changed direction. New season Trade Lambs averaged around 800¢/kg cwt, well above last week and the closing ESTLI of 682¢ (Figure 1).

There has been some rain about and the lower prices of the previous week added to supply resistance. Wagga lamb yardings were down 26%, while sheep yardings plummeted 44%.

There wasn’t a lot of rain around Wagga, but further north some good falls should see the NSW sheep market tighten significantly. Lamb might be a different story, with good prices still likely to draw out lambs which are finished, but it depends on what producers now see as good prices.

The crash in mutton was also halted on Thursday, as it sits just above the same time last year (Figure 2). The rain should be enough to see sheep slaughter continue to fall from recent highs and prices should steady.

Lamb and mutton prices also recently experienced a crash, but they too steadied this week. No doubt rain in the west is adding support, along with the fact that with much cheaper lambs in the West should be seeing product moving quickly into export markets.

Next week?:

As noted earlier, the coming week should see prices steady. Despite the increase in lamb slaughter, it still sits well below full capacity. If we are close to the peak of supply, expect very good prices this spring.

An interesting stat to finish off. The East Coast Restocker Indicator finished Thursday at exactly the same price as this time last year. Higher finished lamb prices are being offset by higher feed costs.