The great fuel robbery of 2018

Fuel prices have seen a dramatic rise in recent days. Talkback radio has been airing calls to boycott the petrol stations. I thought it was therefore worthwhile revisiting fuel prices within Australia – are we being screwed over?

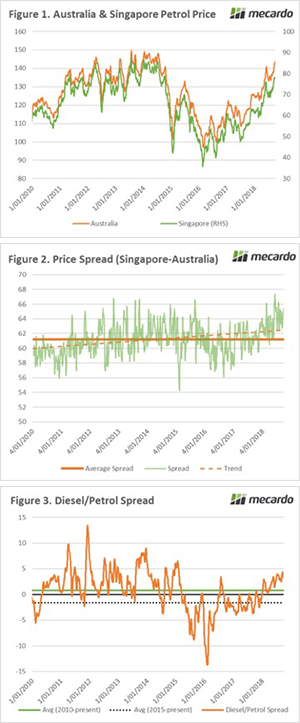

We start our journey in Singapore, where the bulk of our fuel is imported from. In Figure 1, the Singapore and the average Australian petrol price (at terminal) is displayed since the turn of the decade. There is an extremely high degree of correlation between (0.9615), with 1 being a perfect correlation and 0 being no correlation. In effect, this shows that when Singapore prices increase, our prices will also rise.

In Figure 2, the spread between Singapore and the average Australian price has been plotted, with the 7-day moving average to smooth out the data. This will give an indication of whether we are paying a higher premium, and therefore being gouged. However, the current spread is quite close (4¢) to the average compared to the start of the decade (61¢), but in recent years the trend has seen a rising premium in Australia.

The fuel premium in Australia over Singapore can be attributed to logistics and excise duties on fuel. However, the relatively narrow range that the basis trades within can allow us to effectively use Singapore fuel pricing to determine our price (or even hedge).

The major machinery items on-farm use diesel, and whilst we were looking at spreads, it is worthwhile to examine the spread between diesel and petrol prices. In Figure 3, we have plotted the spread, again using the 7-day moving average. At present diesel is currently pricing at a premium over 2.97¢ over petrol. This is above the average of 0.82¢ above petrol since the turn of the decade.

Interestingly however, since the start of 2015, the spread has been a lot lower, with diesel being discounted at 1.6¢ below petrol.

What does this mean?

In reality, this isn’t the great robbery, more a result of market forces.

The cost of my 600km a week commute has increased substantially. As much as it would be nice to blame the fuel companies, the price is a result of the market. It is important to remember that a large chunk of our local fuel price is fuel excise and we will be unlikely to see a government reduce taxes on fuel.

By looking at the numbers, it means that petrol and diesel prices are largely following the international market. There doesn’t seem to be any evidence of gouging, as spreads between Singapore and Australia have remained within the narrow band that we have historically experienced.

To those calling for a one-day boycott of fuel stations. It really won’t make a difference. Those who use a car have a relatively inelastic demand for fuel, if we don’t purchase on one day, we will buy it on another day. The impact on fuel companies will be infinitesimally small.

Key points

- The bulk of fuel in Australia is imported from Singapore

- The correlation between Singapore prices and Australian is 0.98, almost perfect.

- The spread between Singapore and Australia has risen strongly above the decade average.