The panic has set in….. for now

The panic has set in. US wheat markets are caught in a classic weather scare, with the dry conditions outlined in our analysis this week set to continue for another couple of weeks. This has seen ever increasing moves higher in the last three sessions.

Yesterday I was asked, ‘how long have I got to get a hedge on?’ The answer is you’ve got until some rainfall comes on the 7 day forecast for the US. It really is that simple at the moment. Dryness has spurred the market. The start of the month saw funds jump on board. With very little change in fundamentals, in three days CBOT wheat has gained 39¢/bu, or 9.5% with the May contract at 515¢/bu.

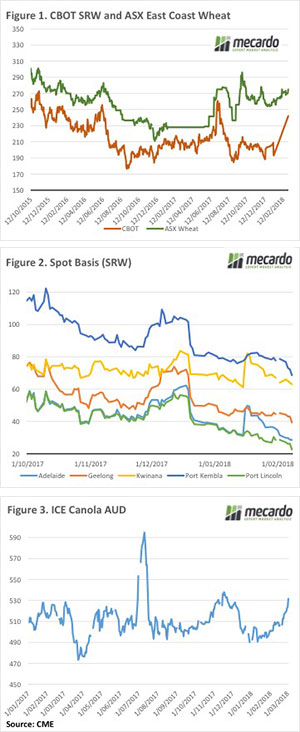

In our terms the May CBOT contract is $243/t (figure 1), December 18 at $264/t and March 19 is at $270/t. The pricing for our new crop, with around average basis, will give a price close to $300/t. In fact, ASX East Coast Wheat futures are offered at $303/t this morning, but this would be a good jump higher (figure 1).

As expected, local prices haven’t risen as quickly as CBOT. There will be further upside today, but in the Geelong Port Zone the $15 rise in CBOT to yesterday had translated into just a $6 rise in APW. Figure 2 shows the decline in basis.

Canola has also found support this week, with ICE futures up again last night to almost meet its early December high in our terms (figure 3). Again, local prices have found some strength from the international market, but basis has weakened to the negative $20-25/t level. This is extremely low.

The week ahead

Should we be selling into this rally? Good question. We don’t like selling at weak basis, but absolute prices are easily at 2018 highs for wheat, barley and canola. One strategy would be to sell futures or swaps for the new crop, and wait for basis for old crop to improve. This will either come from higher physical prices, or lower international values. Most likely lower international values, especially for wheat.