The Russian Steamroller

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

In recent years our comrades in Russia have been the most important driver of the wheat market. Their technology and logistics have improved to ensure that they are efficiently (& cheaply) producing a huge exportable surplus. When there is a hiccup in this region, the impact is felt around the world. In this comment, we look at the past weeks performance, and specifically what is happening in Russia.

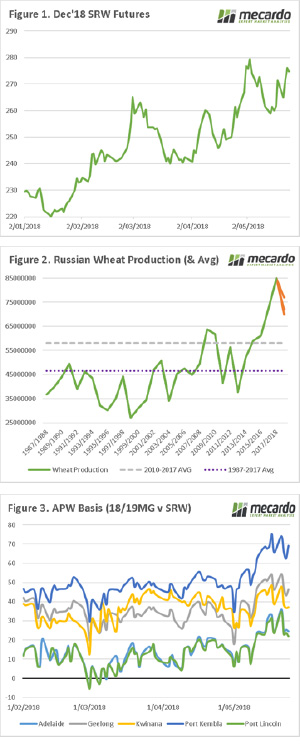

The weather market is in full swing. Last week saw the market lose most of its early month growth, only to post a very strong turn around (Fig 1). At present, December wheat futures are up a$9/mt since the close last Thursday.

The rise in the market can be attributed to poor weather conditions in Australia (more later) and Russia. The Russian wheat growing regions have experienced warm and dry conditions over the past fortnight. These dry conditions in conjunction with limited forecast rain has resulted in concerns mounting. The Russian wheat crop has been down grade with estimates from 70mmt to 77mt, this is a huge drop from the 17.18 record of 84-85mmt.

It is important to put this downgrade into perspective. In figure 2, Russian wheat production since the end of the USSR to present has been displayed. The estimates for this season are displayed in orange. Dependent upon analysts estimates, Russian could produce either the 2nd or 3rd largest wheat crop. It is also mindful to remind ourselves that the average crop for this decade is 58mmt, or 54mmt if you don’t include the past season.

At a local level, the Australian crop remains on the precipice. There has been some meaningful rainfall in parts of central and northern WA, however initial reports are that the great southern and Esperance have largely missed out. The weather forecast has led to a fall in basis levels (figure 3), from the week prior, albeit they remain at attractive levels.

What does it mean/next week?:

The most important factor for Australian producers and consumers of wheat is the local weather. The 8 day forecast for NNSW & QLD remains bleak, and this is where the largest concentration of domestic demand is situated. The continued poor conditions could lead to the incredible high old crop values persisting into the new marketing season.

The negotiations between the US and China will be of interest. Although not set in stone, China have agreed in principle to purchase US$25bn of US agricultural products per annum. It is not clear when this will commence, or what commodities they will accumulate.