Important news from Ukraine and China

In the past 24 hours there has been two news items which are likely to have some impact on Australia. One in the mid to long term, and one in the short term. The uncertainty from China continues, and one of our major export competitors modernizes their practices.

The first piece of news, and most immediate to the Australian market is result of the Chinese anti-competitive dumping probe. This action was taken by China 12 months ago, and under world trade organization (WTO) rules, should have been completed on Monday.

In what is the least surprising news of the year, China has requested an extension. The WTO allow a six-month extension, which means the probing must be complete by the 19th May.

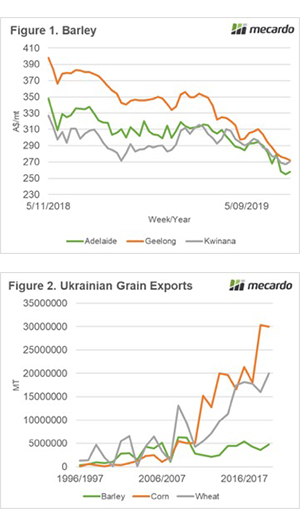

Figure 1 depicts the barley price since over the past year. As we can see the market has largely been drifting lower. These levels are at export competitive levels. The market has largely priced in this extension and we are unlikely to see substantive falls from this point onwards.

The second piece of news is one which is likely to be a slow burner but is likely to impact upon Australia (eventually).

Ukraine has been a powerhouse during the past decade. Exports (especially corn & wheat) have drastically risen (figure 2). This is even though Ukrainian land legislation is quite archaic to many other major cropping nations.

The increase in cropping production which allows for large exports programs is due to the large number of foreign investors. However, these corporate investors are unable to own the land that they are farming. It is not unusual for corporate farms to be leasing land from 100’s of individual landholders.

The opening up of Ukraine to foreign buyers will lead to increases in investments from on-farm right through the supply chain. It is also expected that this will lead to an improved economy for Ukraine.

This doesn’t however bode all that well for Australia, as this has the potential to drastically increase the competitiveness of Ukrainian exports.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean?

Harvest of barley in Victoria is going to jump up a notch this week, which may see some harvest pressure on pricing.

At present the barley-wheat spread is attractive to consumers, with most focusing on accumulating as we move into harvest.