Think before locking in physical sales

It’s the start of harvest, but bids for the 20/21 harvest are now being presented to growers. In this analysis, we look at whether these offer more value for the producer or the buyer.

It is extremely important to be examining the forward markets, as they can often provide strong opportunities to price grain at high prices. The strategy of performing risk management through some forward selling can be through derivatives or physical contracts.

In this analysis, we will look at the current bids for Kwinana and Adelaide.

- Kwinana: A$314

- Adelaide: A$300

At a basic examination, these bids look quite attractive, it provides the grower with a price above the psychological barrier of A$300. However, let’s break it down.

The forward curve for wheat futures (Chicago) is in contango, where the forward months are trading at a premium to spot. Today the Chicago contract (Dec’20), which corresponds with the 20/21 harvest, is trading at A$291. This places the contracts at a basis of +A$23 in Kwinana and +A$9 in Adelaide.

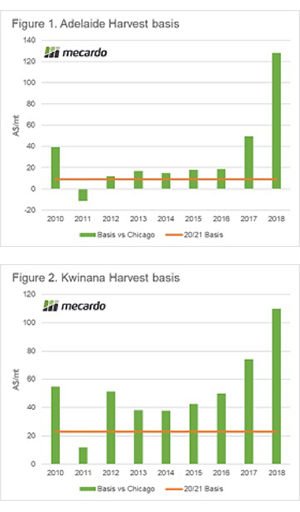

In order to determine whether the current bids provide a good price, let’s look at the historical basis. In figures 1 & 2, the average basis from harvest (specifically December) is displayed in green bars, with the orange line representing the basis on offer with the current 20/21 bids.

As we can see, in the bulk of years basis at harvest has tended to exceed the current basis on the offer of A$9 in Adelaide and A$23 in Kwinana. This was especially so during 2018 when drought had hit Australia and prices responded accordingly.

The buyer at these bids can lock in the basis at below-average levels, and then protect their risk from movements in futures. They will then likely be able to sell the basis on at higher levels at a future date.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean?

If we see a bumper crop in 2020/21, then basis could fall to minus levels. However, at present, we have no way of knowing whether that will be the case.

If we went on the law of averages it would be a better position for a producer to sell futures, and hold locking basis until harvest (or until a better bid is provided).

At present on a flat price basis, these bids are attractive, but by taking them, there is the potential for money to be left on the table.

If you are a premium subscriber and would like to discuss this in further detail – feel free to get in touch.