This is a landmark harvest, but we will get clarity soon.

It’s six days after Halloween. A night of monsters and scares. However, for farmers the scariest matter this year has been the downward progression of crop yields. This has been a landmark harvest where production has been massively down, but prices have declined, however, the headers will give the industry its much needed clarity.

The crop forecasters are now suggesting a <16mmt wheat crop. Which is substantially lower than the ABARES estimate in September of 19.1mmt, and down on last years 17.3mmt. We have spoken at length about the difference in the two years as production shifts back to the east coast.

The market has lost steam in recent weeks as consumers have confidence in being able to accumulate their volumes. As harvest advances, we will get some clarity on the accuracy of forecasts.

One of the few places in Australia hanging on has been Victoria. In recent weeks the Grain Industry Association of Victoria has performed a crop tour. The forecast wheat yield is 2.31mt/ha (wheat) and 3.32mt/ha (barley). Abandonment has also declined year on year, with 8% being cut for hay versus approx. 30% last year.

When we remove this abandonment from the ABARES September forecast, it is now forecast that Victoria will produce 3.4mmt of wheat and 2.6mmt of barley.

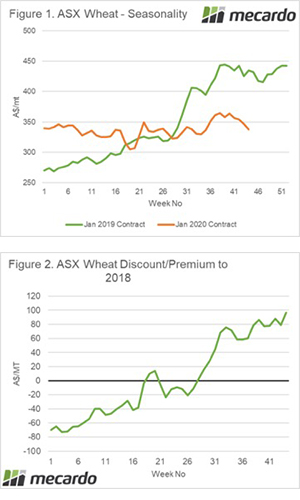

How are the markets reacting to the lower crop? Well there is a continued fall in prices in Australia. The ASX contract has fallen 3% week on week, or A$9 (figure 1). The gap between this year and last year has widened dramatically. At present the ASX contract is A$97/mt lower than this point in time last year.

This year due to the uncertainty most growers have sold less than normal ahead of harvest. This makes perfect sense as a strategy whilst crops have deteriorated. This however especially in Victoria could lead to a large volume of grain hitting the market all at the same time.

What does it mean / next week?:

Consumers are now examining their ability to increase their use of barley. Due to the wide spread to wheat, it is more attractive to feed. This will likely add some pressure to wheat prices, as demand technically drops by the maximum volume allowable as barley in a ration. However this may be short-lived.