Throughput levels and price volatility.

South Australian mutton displays a higher degree of price volatility than their counterparts in NSW and Victorian markets. Indeed, over the 2018 season, SA mutton has experienced a range in price more than 300¢ compared to the 135¢ to 180¢ range displayed by NSW and Victorian mutton, respectively.

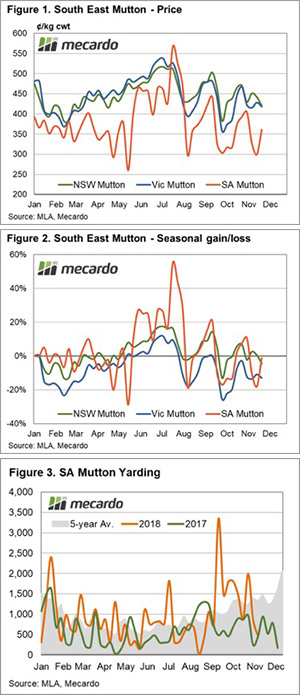

Analysis of the price behaviour of mutton in the southeastern mainland markets highlights the close relationship between mutton prices in Victoria and NSW. Since the beginning of 2018, the weekly mutton price in Victoria and NSW hasn’t been more than 40-50¢ apart and have followed each other relatively faithfully (Figure 1).

In contrast, while the broad trend for SA mutton has been following the pattern set by Victorian and NSW markets, there have been times in the season where SA prices have diverged wildly. There have been several occasions throughout the current year when SA mutton prices have moved beyond a 100¢ discount to Victorian/NSW prices and one time when the discount breached 220¢.

Measuring the relative weekly gain or decline in mutton prices for the three states from the beginning of the season in percentage terms helps to quantify the volatility inherent in SA mutton price movements (Figure 2).

SA mutton has seen price falls extend to nearly 30% during May and gains as high as 55% during this season. Victorian mutton prices have been as much as 26% below and 12% above the January opening price. NSW mutton has fared slightly better over the season, posting a 13% price decline and an 18% gain.

What does it mean/next week?

Analysis of weekly throughput levels this season shows that in NSW mutton numbers have averaged around 15,000 head. The higher volumes seem to help reduce price variability as individual lines of stock contribute a smaller proportion to the average prices reported in any given week. As a result, a poorer or better sales outcome doesn’t impact the average price across all sales.

This inverse relationship between price volatility and throughput volumes is also evident in the Victorian mutton data. There has been an average of around 7,000 head of mutton a week at Victorian saleyards this season, which is just under half the NSW average. The price volatility in Victoria has been slightly higher than in NSW.

Similarly, SA reports average weekly mutton throughput of around 1,200 head and the price variability between weeks is significantly higher than other two states (Figure 3). The thinner volumes mean that average prices are more susceptible to influence by poorer or better sales outcomes on a given week. Yards with higher volumes will attract more buyers, bringing greater competition which in turn means that prices can’t be manipulated by a single buyer or small group of buyers with market power.

Key points:

- Weekly mutton prices for Victoria and NSW are rarely more than 40-50¢ apart and show a lower degree of volatility than SA mutton prices, week on week.

- SA mutton prices have ranged over 300¢ in price during the 2018 season, compared to 135¢ NSW and 180¢ for Victoria.

- Higher throughput volumes appear to be synonymous with greater price stability.