Turnaround Thursday (at least partially)

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

There has been a slight turnaround in the market, but overall prices are substantially more attractive than they have been in the post-harvest period. In this week’s commentary, we examine the potential impact of crude oil on Australian wheat, and why we should be aware of it.

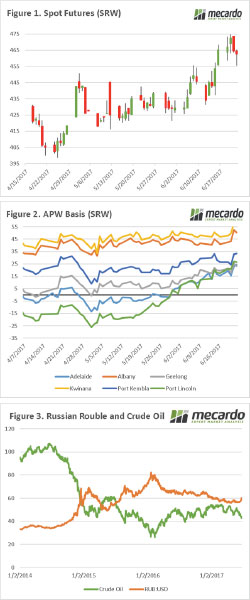

There has been a welcome (for sellers) rally in the wheat futures over the past fortnight (figure 1), as a result of weather woes in the US. Overnight however the market performed a partial flip and dropped around 2%. The trade will be watching the weather with close eyes, especially as Russian crops look to again be in good condition. This factor, combined with a depreciating rouble (more on that later), is likely be putting some caps on futures for the next few days.

At a local level, there are still major concerns about the coming harvest which has led to a substantial rise in pricing. This has especially been seen with continuing strengthening in basis in Adelaide & Port Lincoln (figure 2).

In addition to supply concerns for the coming season, the growers are not surprisingly reluctant sellers. This has led to the market paying up to acquire some cover, however we need to be aware that if the concerns start to be alleviated, then the interest from the trade may diminish. There is still a long way to go until harvest, and we shouldn’t write off the crop at the end of June.

As we all know, foreign exchange plays a factor in commodity trading. The Russian economy is largely dependent on oil revenues, and is also a major competitor for Australian wheat. In figure 3, we have charted the Rouble against the US$, and the price of crude oil since early 2014. This period has seen a reduction in crude oil prices, which has led to a weakening of the Rouble, the correlation between the two is almost perfect at -0.96.

The oil price in recent weeks has started to slide again, and the market remains bearish which has resulted in a further deterioration in the Rouble. If the fall in oil continues, then by proxy Russian wheat will become more competitive on the market.

Next Week

Like a broken record, the trade will largely be concerned with weather events in the northern hemisphere. As the days flow, any weather risk premium in the market will lessen unless we see some major production failures.

We still have to keep into account that even when excluding Chinese wheat stocks, the world still has considerable supplies.