“Unrelenting” – a new describer for the wool market?

“Unrelenting” was the term used to describe the market by AWEX at this week’s wool sales, as fine wool continued to lead the upward movement. Recent terms to describe the wool market have been less flattering or positive, so either we are getting caught up in the hubris of finally seeing good prices, or “this time it’s different”?

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook.

Again, fine wool was the outstanding performer but the underpinning of the medium wool price (21 MPG) is providing support and optimism for the ongoing strong market outlook.

With the 21 MPG now 240 cents higher year on year and touching 1500 cents; the bigger story and the key confidence booster is the fine types. 18 MPG is now almost 700 cents above year ago levels; of interest is that in March 2015 the 18 MPG quote ranged between 1440 and 1470, this year the last 3 weeks has seen it move each week upwards, beginning at 1784 (Melbourne) and this week quoted at 1910.

Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year.

Cardings again were dearer, with all selling centres reporting the Carding indicator comfortably above 1200 cents. The average price for Merino wool is currently boosted by the prices for the lessor lines, all contributing to the best cash flows seem for wool producers for many a year.

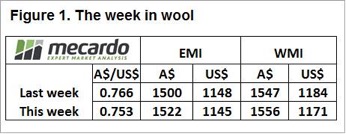

There are many in the industry forecasting this market to at least hold these levels, and perhaps also that the tighter supply in the winter will push to some extreme pricing. There is good support for this rationale, supply is tight at all stages of the supply line, with exporters also reporting that they too are now able to make margins on trades as processors step up to purchase. It is of note that although these are long term record prices for growers, it is still below the peaks of 2010 – 11 when the Au$ was at parity. (Fig 1.) This supports the prospect of the market may still have some steam left in it.

This “hand-to-mouth” situation will support demand, and with woolgrowers “cashed up” any minor retracement in the market will result in reduced offerings as growers step back. The tight supply situation may provide a rare opportunity for producers to influence a market in their favour.

The ongoing strong auction is providing good opportunities in the forward market with Riemann trading across a range of maturities from 18.5 to 21 MPG contracts.

The ongoing strong auction is providing good opportunities in the forward market with Riemann trading across a range of maturities from 18.5 to 21 MPG contracts.

The week ahead

While the EMI rallied a further 22 cents this week, in US$ terms it actually fell 3 cents on account of the Au$ down by over 1 cent.

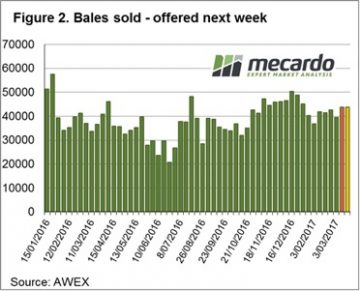

A reduced offering of 43,700 bales is rostered for next week, down 2,200 on this week. In fact, clearance to the trade this week was also 43,700 bales, so a smaller offering along with the renewed positive sentiment should see the market hold or improve next week.