We continue to live in interesting times

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

It is going to be a very interesting fortnight. All the major factors which impact grain pricing are likely to come into play, adding volatility. In this weekly update, we take a look at the two big uncertainties – geopolitics and European downgrades.

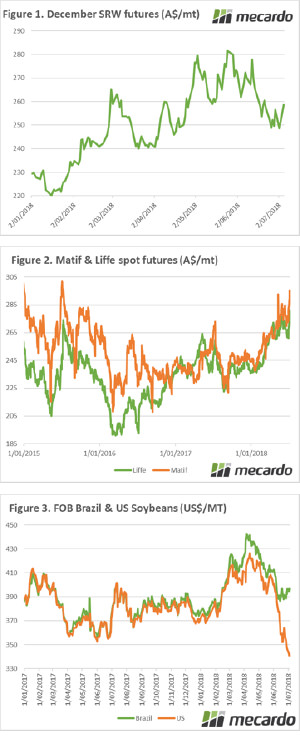

The US futures markets were closed for the 4th July celebrations. When they opened, they have done so with a bang. The December SRW futures contract is up 3% overnight or A$7/mt (Figure 1). This puts us back to slightly above the end of last week.

The rise can be attributed to the dry weather conditions in western Europe. The run of hot weather and poor rainfall has resulted in downgrades in Germany and France. The German crop was yesterday lowered to 41mt, the smallest since 2007 (and 9% lower year on year). In the past week, the French crop was reduced by 4mmt.

Even in god’s country (Scotland), I am hearing from contacts of yield expectations being the lowest in recent memory. The national farmers union have reduced the UK crop from 14.5mmt to 13.5mmt. These drops have led to a sudden rise in French wheat futures (matif) and London wheat (liffe) which can be seen in Figure 2.

The tariff scuffle between the US and China will likely kick up a gear today as tariffs are set to be enacted. The US government will commence tariff collection at 2 pm this afternoon, with China to begin retaliatory tariffs immediately after. In recent hours Trump has escalated concerns, commenting that $500bn in Chinese exports could be targeted. The Chinese threat of tariffs on US soybeans has led Brazilian supplies achieving strong premiums (Figure 3) – in fact, the largest premium since 2004.

Also, if you would like to hear my dulcet tones you can watch my market update on The AgShow on the link below:

Commodity market Update

What does it mean/next week?:

There are three main areas to keep an eye on during the next week:

-US/China tariff escalation. Any impact on the Chinese economy is likely to result in a fall in the A$.

-Rainfall. NNSW remains quite dry, with very little rain due in the next eight days.

-Europe. As the EU starts to harvest, will the old adage of a small crop getting smaller come into play?