What a difference a month made

What a difference a month made, seven hundred and thirty little hours. The market has turned 180° since this time last month. In this week’s comment, we take a look at what has caused this move.

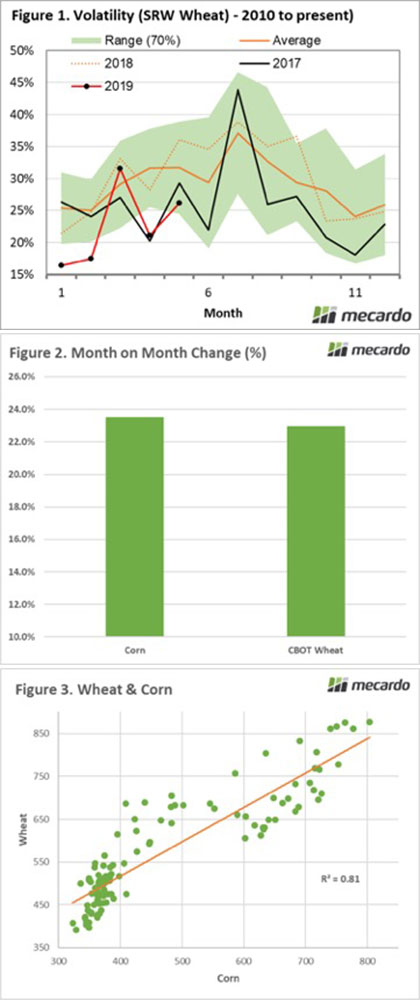

The market tends to be volatile towards the end of the second quarter of the year (Figure 1), and this year is no exception. At the start of May, the global environment had a bearish undertone. The USDA had forecast a year of ample production with most of the grain growing regions experiencing strong annual growth. This led to a projected production of 777mmt and end stocks of 293mmt, both record levels.

The picture with wheat is likely to change in June when the USDA releases their updated datasets, however not by much. So why is the wheat price globally jumping?

The US has received unprecedented rainfall during May, which has meant that areas forecast for corn are now more suited for trout. In the United States, producers are heavily reliant upon insurance. To comply with the insurance coverage there are set final planting days. If you plant beyond the date coverage is dropped by 1%.

Click below to see maps:

The impact has been dramatic, with corn and wheat prices on CBOT rising 23% (Figure 2). Although wheat production remains favourable the issues with corn have flowed through to wheat.

Agricultural commodities tend to have relationships with one another, as they are ultimately in groups of replaceable products. As an example, soybean and canola can be interchanged (to a certain extent). This is also the case with corn and wheat, which both have a high degree of relatedness.

This relationship can be seen in figure 3, which shows that as the price of either commodity rises the other will follow.

On our podcast, we had a chat with Brett Hosking, chair of Grain Growers. In this conversation, we discussed the opportunities for the grain industry over the next few years and the importation of wheat in Australia.

Click here

What does it mean/next week?:

The market will remain well supported in the coming weeks (and months) the nature of the rainfall events in the US will lead to a very sharp drop in expectations for the corn crop.

There are many who are considering that the rise in corn price will lead to farmers planting later and accepting a lower coverage. However, I don’t see this as likely as logistically it seems implausible for many farmers to be able to plant.

In Australia, expectations are also deteriorating with the outlook for rainfall not promising. Every week without decent rainfall will lead to an increase in basis levels.