What do US soybeans and the Socceroo’s have in common?

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.

The past week has largely been void of new fundamental data to move markets. The big issues of the week are political in nature, with only one week until tariffs are in place against a multitude of US agricultural products. So, what do US soybeans and the socceroo’s have in common? They are both uncompetitive.

The wheat market continued to retreat over the week, with Chicago futures down 11¢/bu or A$3/mt. Northern hemisphere producers have started selling their crop, placing pressure on the market. Will this continue or will growers stop once they have met their cashflow requirements?

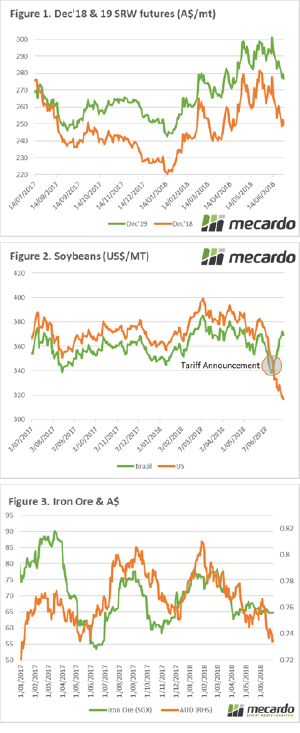

In Figure 1, the December futures contract for both 2018 and 2019 is displayed. As expected both contracts have experienced a decline in line with one another. In past analysis articles during April and May, we have outlined good hedging opportunities, especially for December 2019.

During this point in time, it would have been feasible to lock in A$295-300/mt. At even the most conservative estimate of basis, this would have led to a price well above $300/mt. At present, the Dec’19 contract has contracted to A$276/mt. Although a less attractive hedge, it would still provide an attractive price; using average basis levels this would likely lead to a $300-310 price.

We are one week away from implementation of Chinese tariffs against a multitude of US agricultural products (see here). China is set to implement a 25% tariff on US soybeans, this instantly makes US supplies uncompetitive versus other origins. The result can be seen in Figure 2, which displays both US and Brazilian soybean prices. Brazilian soybeans have moved from trading at a discount to the US, to trading at a strong premium (US$50/mt).

If the tit for tat retaliation between the US and China continues, we could see a reduction in global trade. Our currency in recent years has largely followed the economic performance of China. In the past week, we have seen the A$ drop to the lowest levels since early 2017 (Figure 3). It will be interesting to keep a keen eye on Iron ore pricing, as this can be an indicator of economic performance in China.

What does it mean/next week?:

There has been a lack of fresh data in the past week, however, there will be new data released from Canada and the US. Reports at this time of year can provide big surprises, as real data from the field flows into the analyst’s lap.

The rainfall in QLD/NSW this week was not quite as healthy as hoped however provided a lifeline. There are substantial falls expected for WA towards the middle of next week, which will hopefully provide a floor in yield.