Wheat gets a boost from the WASDE

Normally World Agricultural Supply and Demand (WASDE) reports released early in the year are relatively benign. The old crop is largely known, with only minor changes in exports to move the market. Not this month however, with wheat getting a boost thanks to some surprises.

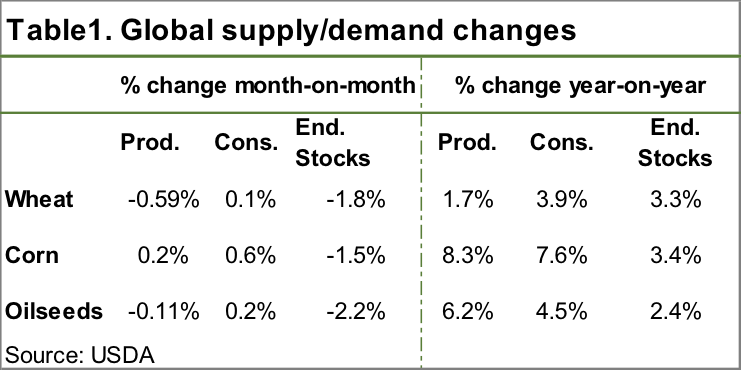

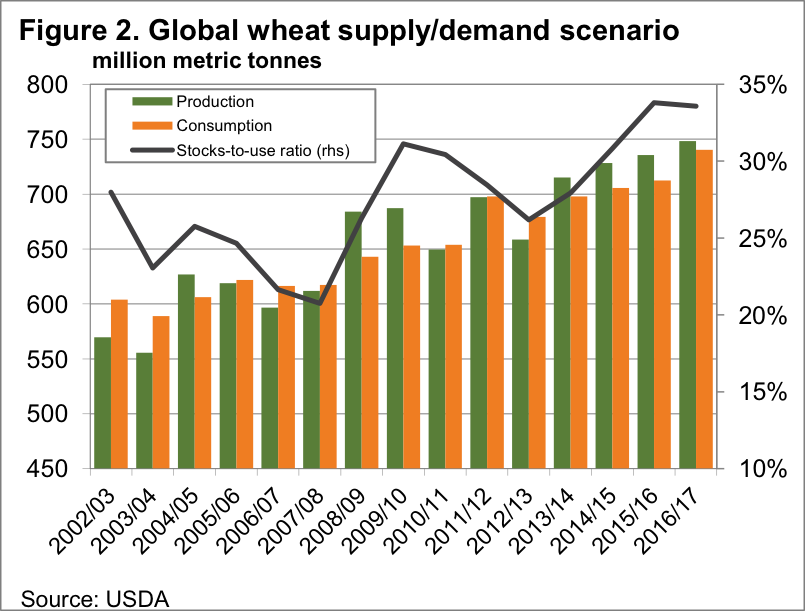

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year.

World wheat production was cut by 4.4mmt this month, largely thanks to a downgrade in India. The United States Department of Agriculture (USDA) are still saying 2016-17 will be the biggest crop on record. However, a small increase in consumption (Table 1) and a decrease in ending stocks saw the stocks to use ratio decline from 34.2% to 33.5%. Sounds small, but as shown in figure 2, the stock to use for 16/17 is now smaller than last year.

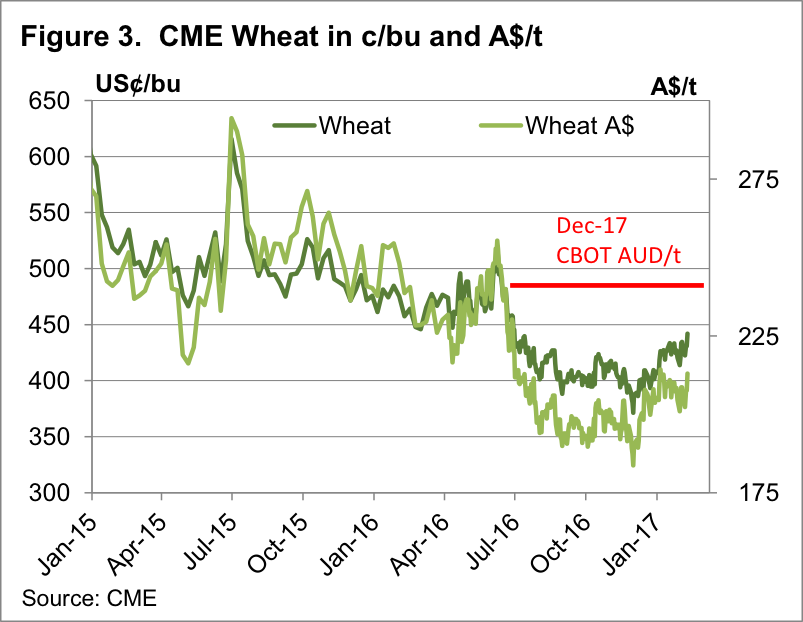

In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016.

In theory, a smaller stocks to use ratio should mean higher prices than last year. This had funds jumping out of wheat last night, pushing the CBOT spot contract to a 7 month high of 442¢/bu (figure 3). Still a long way from the 500¢ of February 2016.

In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

In our terms the stronger AUD sees prices just below the 7 month highs hit in January, with the spot contract at $213/t, up $5 for the week, and Dec-17 at $238/t, shown by the red line on figure 3. There is full carry into Dec-17, and those concerned about prices ticking along at current levels for another year might be tempted to sell a bit at these levels.

Soybeans took a bit of a hit on an upgrade in US stocks, but oilseeds in general were stronger. ICE Canola has moved back to its recent high of $CA527/t which in our terms is exactly the same, thanks to the currencies being at parity.

The week ahead

Old crop wheat has found a little bit of strength in the last week as a stronger CBOT, and buying for export shipments has added $5-10 to APW and ASW prices. The latest jump in CBOT might add another few dollars today.

The latest WASDE shows we are entering a traditionally volatile period for grain prices on international markets, and there might be opportunities to take some derivative cover for next year, or even on physical sales to be made later in 2017.