Where are we headed when supply picks up

On Tuesday Mecardo published the semi-regular look at processor margins on slaughtering cows. The model confirmed that processors are still struggling, with the cost of the cow and processing outstripping the value of the meat and co-products produced. We thought we take a look at where prices might settle under current beef prices, when supply finally reverts to something towards normal.

The current margin on cows for processors comes in at negative $34 per head. The margin model is based on a cow weighing 500kgs liveweight, or 260kgs carcase weight. Basically the loss being worn by processors at the moment equates to 13¢/kg cwt.

The current margin on cows for processors comes in at negative $34 per head. The margin model is based on a cow weighing 500kgs liveweight, or 260kgs carcase weight. Basically the loss being worn by processors at the moment equates to 13¢/kg cwt.

Obviously cattle processors are not in the business of breaking-even, they aim to make money. The processor margin model shows an average profit on cow processing of $50-70 per head for most of the year. The average margin drops to $0-10 during the tight supply months of July to September.

With break-even just 13¢ away, there is not much prospect of cow prices falling during the tight supply period we are about to enter. Come October, however, for processors to make the average $50/head margin, cow prices would have to fall 31¢/kg cwt, or 6.5%, to 430¢/kg cwt.

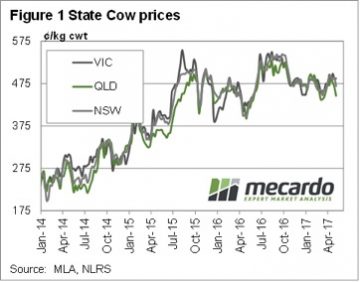

In fact, prices in Queensland are nearly there, sitting at 446¢/kg cwt last week (figure 1). There is still upside potential for cow prices over the coming months, with the prospect of tight supply sending processor margins toward the $150 losses seen last year. To reach these deeply negative margins under current beef prices, cows would have to make 520¢/kg cwt. Last winter and spring cows were making 540¢, so this is not out of the question.

In fact, prices in Queensland are nearly there, sitting at 446¢/kg cwt last week (figure 1). There is still upside potential for cow prices over the coming months, with the prospect of tight supply sending processor margins toward the $150 losses seen last year. To reach these deeply negative margins under current beef prices, cows would have to make 520¢/kg cwt. Last winter and spring cows were making 540¢, so this is not out of the question.

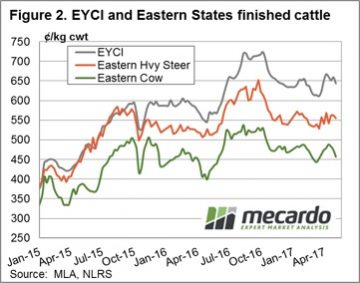

Beef export prices govern all cattle prices, and all cattle prices move together. We can use projected cow prices to give an idea of heavy steers and young cattle prices. Figure 2 shows that heavy steers have ranged between a 50 and 100¢ premium to cows over the past three years. The EYCI has held a premium as strong as 200¢, and as weak as 100¢.

Key points:

- The processor margin model gives us an idea of where cow prices might go under tightening or loosening cattle supply.

- Cow prices could rally up to 15% during winter, and fall 6% from current levels later in the year.

- Heavy steer and young cattle prices could range from 15% higher, to 20% lower depending on seasonal conditions.

What does this mean?

When you get out to forecasting young cattle prices, the ranges can be quite large. The EYCI could go as high as its 2016 peak. However, during dry spring the EYCI premium to cows could be squeezed back to 100¢, which under current beef export prices, would see it as low as 520¢/kg cwt. This equates to a 20% fall in price, and would represent a two year low.

Obviously the season will in part govern where processor margins sit, and how the young cattle premium reacts. What we do know is that supply should be stronger this year in the spring and summer, so unless we see a rally in export prices, or a fall in the Aussie dollar, we shouldn’t be budgeting on similar prices to last year from October onwards.