Where is all the broad merino wool coming from

Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from.

Recent sales volumes and AWTA data have shown strong increases in the supply of broad merino wool in Australia. While the supply was expected to pick up on the back of improved seasonal conditions in 2016, the rise has been faster than anticipated. This article takes a look at where the wool is coming from.

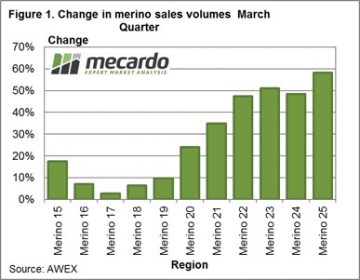

Figure 1 shows the year on year change in auction volumes for merino wool from 15 through to 25 micron, in the January to March period for this year. The stand out change is the big (30-50%) rise in the 21 micron and broader merino categories. Fine wool volumes have also been ahead of year earlier levels but the small increases in the face of massive prices rises indicates there is not a lot of spare supply of fine merino wool in Australia.

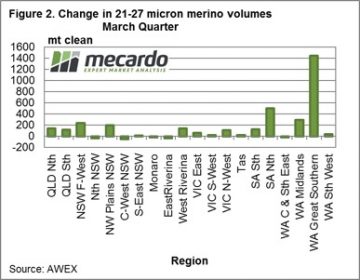

The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago (Merino means different things) around half of the broad merino production comes out of pastoral regions with the balance coming from cropping regions. Figure 1 shows the year on year change in the supply of 21-27 micron merino wool for the past three months by region, around Australia. One region stands out as contributing extra 21-27 micron wool in the March quarter. This region was the Great Southern from Western Australia. In recent years this region has been the dominant supplier of greasy wool to sale in the January through April period, accounting for 15-18% of sales by volume. This year the fibre diameter of wool coming out of the Great Southern has swung broader, so it has supplied nearly half of the extra 21-27 micron wool sold during the past three months. The Midlands, also from Western Australia, has helped as has northern South Australia and the pastoral regions running northern and east from South Australia.

The question is where is the extra broad merino wool coming from? As Mecardo showed in an article a couple of weeks ago (Merino means different things) around half of the broad merino production comes out of pastoral regions with the balance coming from cropping regions. Figure 1 shows the year on year change in the supply of 21-27 micron merino wool for the past three months by region, around Australia. One region stands out as contributing extra 21-27 micron wool in the March quarter. This region was the Great Southern from Western Australia. In recent years this region has been the dominant supplier of greasy wool to sale in the January through April period, accounting for 15-18% of sales by volume. This year the fibre diameter of wool coming out of the Great Southern has swung broader, so it has supplied nearly half of the extra 21-27 micron wool sold during the past three months. The Midlands, also from Western Australia, has helped as has northern South Australia and the pastoral regions running northern and east from South Australia.

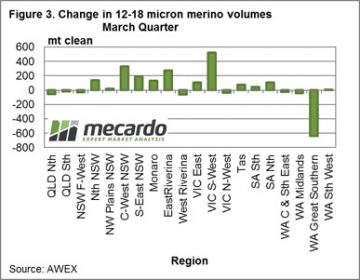

As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool.

As a check on this change, Figure 3 shows the year on year change in the volume of 12-18 micron wool sold by each region in the March quarter. The big swing to broader wool in the Great Southern region is matched by a big drop in 12-18 micron volumes. Notice the higher rainfall NSW regions have had increased fine wool sales this year, along with south-west Victoria (which was coming off a drought induced low base). The expected decrease in supply of fine wool from NSW has not eventuated, except for the western Riverina. Good seasonal conditions in 2017 (which has started in the Monaro) will be required to pull the micron broader in the regions, in order to lower the supply of fine merino wool.

Key points:

- Broad merino sales volumes have been some 30-50% higher in the March quarter.

- AWTA volumes correlate with the sales volumes.

- Half of the increase has come from Western Australia.

- Fine merino volumes have been maintained in the higher rainfall regions of NSW.

What does this mean?

The extra volume of broad merino wool (in the order of 30-50%) will continue to put downward pressure on broad merino prices. Seasonal conditions in Western Australia (where half of the increase has come from) are shaping up in 2017 to support this increased supply. The chance of the 21 MPG breaking the 1500 cents barrier looks to have well and truly slipped away. NSW has maintained its volume of fine wool production in recent months, above expectations. The expected boost to fine wool prices from a drop in supply looks as though it will be weaker than expected.