Whilst some work with ambiguity the market has direction (unfortunately)

Key Points

The world is slowly creeping out of isolation and there is still a large degree of uncertainty about the road ahead. Will there be a second wave? Will the economy recover? The wheat market, however, does not lack direction, it has got direction and it is in one way.

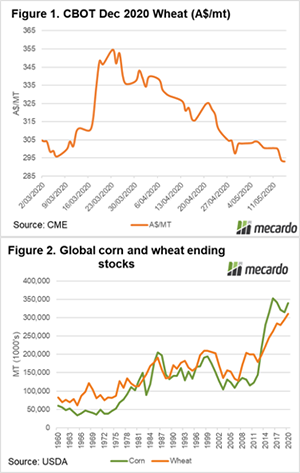

The Chicago wheat futures market has declined further this week. There has been continual deterioration with no days of gains since last Thursday. The market (in A$) has been in almost a continual downward direction since the 23rd of March, when the December contract hit A$355. This same contract is now A$293/mt (Figure 1).

The USDA released their May WASDE report. This was a bearish report and has added extra pressure onto the market. Global supplies of wheat are expected to be record high, with at the end of this season the largest stockpiles of wheat the world has ever experienced (Figure 2).

As discussed numerous times on Mecardo, the corn market has been under pressure in recent months due to the demand destruction caused by reduced ethanol demand. Ethanol production will likely rebound when the economy reopens, albeit slowly if unemployment levels remain high. The result being that corn end stocks will be close to record high on a global level. In the US end stocks will be the highest since the late ’80s.

Corn and wheat are irrevocably linked. If corn continues to be under pressure, it is likely to see wheat fall in sympathy.

The USDA reported that Australia would be up year on year by 8mmt to 24mmt. The range at present is likely to be 24-27mmt based on the current outlook.

What does it mean/next week?

The world continues to be awash with cereals. The COVID-19 economic impact has raised new issues around demand which is likely to cause a large degree of uncertainty in the coming months.