Wool delivers volatile opening

The strong finish to 2019 wool sales provided the platform for an impressive open to the 2020 selling season. The robust demand over the Christmas break on electronic offer boards provided the entrée to spirited activity on the auction floor when sales recommenced on Tuesday.

However, the fragility of the market was reinforced on the final two days of selling. By Thursday, with only Melbourne & Fremantle in action the market had given back much of the early week gains.

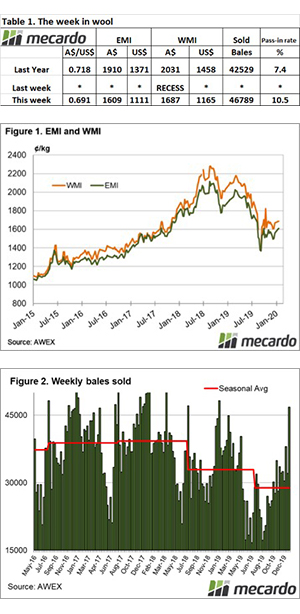

The Eastern Market Indicator (EMI) lifted 79 cents early on Tuesday before easing to close at 1,609 cents, in the end an improvement to the 2019 December close of 51 cents. The AU$ strengthened, up .06 cents to sit at US $0.69. In US terms, this moved the EMI up 45 cents to 1,111 cents.

The Western Market Indicator (WMI) also had a good week gaining 16 cents for the week to finish at 1,687 cents. Initially, W.A. played catch up to the opening prices of Sydney & Melbourne, however, it then reverted to the buyers’ more cautious approach evident in later sales.

The national offering of 52,261 bales came forward, a typical elevated January offering. The pass in rate increased slightly (heavily influenced by Wed & Thursday sales) to 10.5% nationally. This meant that 46,789 bales cleared to the trade. This was the largest clearance of bales since January 2019.

The dollar value for the week was $80.95 million, while the combined value so far this season is $1.139 billion.

The market is currently displaying a level of “nervousness”, caused by a combination of relatively high prices, tight supply (with the expectation of further dwindling supply later in the year), and growers’ propensity to happily pass-in wool. This is a welcome situation for sellers, but equally a more difficult market for buyers and processors to navigate.

The crossbred types ended the week largely unchanged, although the strong buyer activity early in the week pushed crossbred wool prices up by 10 – 20 cents before retracing. Cardings in all centres finished stronger, ending the week 40 – 50 cents to the better.

The week ahead

Despite the late week fluctuations, the market performed well under increased supply.

Next week is another substantial offering of 59,890 bales. There will be a close watch this week on the offer boards to try to glean an indication of market direction.