Are we independent?

Is the Australian grain industry a lone continent removed from the vagaries of overseas pricing? Are we independent of the rest of the world? In this article, we take a look over the past few months to see the driver of pricing.

Derivatives play an important part in pricing grain, even if you do not use them to manage your risk – the derivatives market will impact the price that you receive. In recent weeks we have heard from many that futures aren’t important because our pricing is disconnected from the rest of the world.

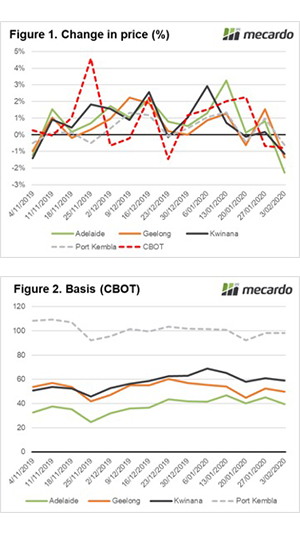

In figure 1 the change in price (as a %) is shown for four ports in Australia and the CBOT price. As we can see the price movements onshore and offshore are following one another quite closely.

These ports show a strong correlation between CBOT (in A$/mt) and the local port price. The correlation since the start of harvest is shown below, with 0 being no correlation and 1 being a perfect correlation.

- Adelaide 0.95

- Geelong 0.91

- Kwinana 0.95

- Port Kembla 0.91

The basis levels in Australia have traded within quite a narrow range since the Christmas break. The pricing levels in Australia have moved higher through January and with a relatively unchanged basis, we could argue that much of that has come from the rise in futures.

What does it mean/next week?:

The correlation between overseas futures, in this case, Chicago, are strong. This means that if prices move in CBOT, then the local price will likely follow.

The importance of futures cannot be stressed enough therefore it is worthwhile including them in your risk management strategy.