Beef exports down but China still rising

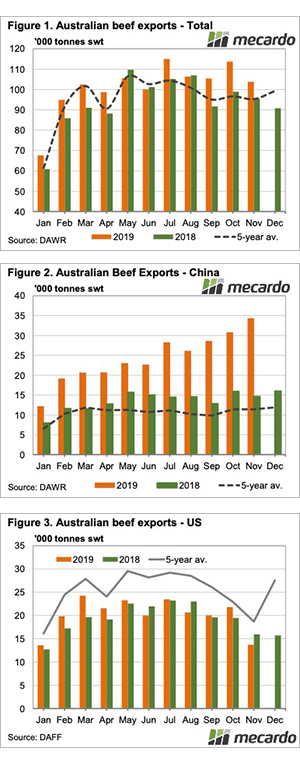

Beef export figures for November are out, and we are getting a picture as to why export prices have been running rampant. While the total supply of beef for exports declined in November, it didn’t stop China from posting yet another record import level.

Cattle slaughter was still relatively strong in November, so it is likely the cattle were lighter. November beef exports were down 9% in October, but up 9% in November 2018. In fact, November exports have only ever been higher once, in 2014.

Declining export volume didn’t stop China from taking yet another record amount. Figure 2 shows China was easily the biggest market for Australian beef, taking 33%. The comparison numbers again show rapid growth. The 34.2 million tonnes exported to China (figure 2) was up 12% in October and 134% in November last year.

With 90% of the beef exported to China being frozen, it is pulling more and more beef away from the US. Figure 3 shows declining US exports, with November being down 37% on last month and 14% on last year. Exports in November were also the lowest for that month since 2016, when total supplies were much tighter.

The US share of exports was 26% back in November 2016, and just 13% last month. This share was the lowest since 2010. There is not a glut of beef in the US, they are still very much chasing our exports. It seems that China simply has more money for beef at the moment.

Japan and South Korea managed to maintain their share of our beef exports, but in general, they are after more expensive cuts of beef. With manufacturing beef prices still rising, there might be some better cuts going through the grinder.

What does this mean?

We’ve been following the rising 90CL beef prices over the last month and the rally in price fits nicely with export flows. The reports of US buyers scrambling for beef in a rising price environment shows up in much more beef going to China and much less to the US.

The market is still waiting for Chinese beef demand to flatten out, and see some sort of equilibrium reached in export markets. At present, however, things are still highly uncertain.