Big offering but market solid

After 8 weeks of consecutive rises in the wool market, producers responded with a large offering which resulted in a clearance to the trade of 44,800 bales.

The opening sales in Melbourne followed the weak finish in Fremantle last week. However, by the close on Thursday, it was a positive sentiment, with all centres posting gains on Thursday.

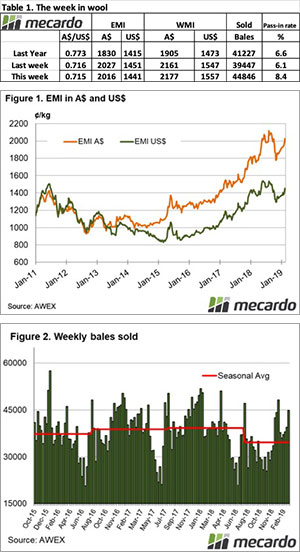

The Eastern Market Indicator (EMI) eased over the week, falling 11 cents by the end of the week to 2,016 cents. The Au$ was again slightly weaker also. The EMI in US$ terms was lower, down 10 cents to end the week at 1,441 US cents (Table 1).

In Fremantle, the Western Market Indicator (WMI) had corrected late last week, so this week it lifted a further 16 cents to end the week at 2177 cents. This is now the highest level since September2018.

48,948 bales were offered for sale this week, with the trade clearing 44,846. This is 5,400 bales more than last week, a sign of confidence from buyers and a signal that growers are pleased with these levels. Only 8.4% or 4,102 bales passed in.

In the auction weeks since the winter recess, 943,537 bales have been cleared to the trade, 190,651 fewer than the same period last year. The average shortfall cleared to the trade compared to the same time last year now sits at 7,061 bales per week fewer.

The dollar value for the week was an impressive $99.27 million, for a combined value of $2.24 billion so far this season. A simple calculation of $ value divided by bales sold gives us $2,215 per bale across all types.

Crossbred types were mixed, 28 & 30 MPG were cheaper of last weeks record levels, while 26 & 32 MPG’s were up 10 – 20 cents.

The week ahead

According to the AWEX roster, the next week is another solid offering of 46,000 bales predicted, a big increase on last weeks estimate. The roster then drops sharply with 38 & 37,000 bales rostered for the next two weeks.

The tightening supply on the horizon should see the market activity remain robust, at least for the foreseeable future.