China driving beef exports in October

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

It has only been a week since China’s ban on a number of Australian beef exporters was lifted. Without the ban, beef exports could be expected to surge in November, but despite weaker total exports, the trade with China has already hit a two year high in October.

We continue to bemoan the lack of weekly slaughter data, export data can be a bit of a proxy for beef production. Total beef exports for October fit nicely with the theory that cattle supply has been tighter, and pushing prices higher.

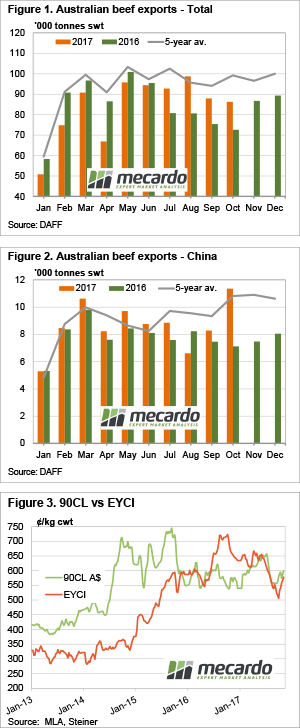

Figure 1 shows that while Australian beef exports remained very strong relative to last year in October, exports did decline relative to last month and winter figures. On average total beef exports rally in October as cattle supply improves, but rather than a 5% increase on September, we saw a 2% decline (figure 1).

Changes in beef export volumes to Japan and the US were broadly in line with the total trends. This is expected as Japan and the US accounted for 48% of total beef exports. There were a couple of big movers however.

Exports to South Korea were much lower, down 18% on September and 20% on October last year. Making up for lower exports to South Korea were surging exports to China (figure 2), which were up 37% on September and 60% on October last year. In fact, despite the ban on some processors, beef exports to China were at their highest level since December 2015.

China failed to move into third place as our export destination, but the 11,353 tonnes fell just 15 tonnes short of South Korea.

What does this mean?

Weaker cattle and beef export prices (figure 3) in September and October may have helped drive increased exports to China, as it is a price sensitive market. It will be interesting to see if November and December exports to China are as strong, with a recovery in prices likely to have been passed on to importers.

Other major export markets generally have more money than China, and with higher prices and a smaller supply, Chinese exports may subside despite the reopening of the market to the banned processors.

It is good to see demand for Australian exports is still strong, and the Chinese are seemingly poised to soak up supply when prices get cheap enough. This suggests there might be a solid floor in the market until there is a heavy increase in supply.