Demand suggests plenty of cattle upside

The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

The cattle market appears to have found a base in recent weeks, and this is due to supply finding a top, and good processor margins seeing cattle being soaked up. So where to from here? This week we take a look at demand, and where the market will head when supply tightens up again.

The fact that beef is sold into a competitive international market means that supply and price have a variable relationship. As opposed to lamb, where shifts in supply are generally the driver of price, cattle markets are more subject to things beyond producer control. Factors like beef production in competing nations, shifts in demand and exchange rates tend to be the main driver of cattle prices.

So a traditional supply and demand curve doesn’t exist for Australian cattle prices. However, a couple of years ago we discovered a supply and demand relationship which does tend to ring fairly true. If we take the 90CL Frozen Cow export price and deduct the Eastern Young Cattle Indicator (EYCI) it gives us a measure of how local prices are faring relative to the international market.

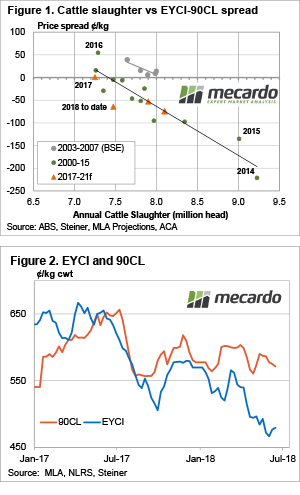

In Figure 1, we have plotted the annual cattle supply against the 90CL/EYCI spread. It shows that the higher supply is on the X axis, the lower the spread is on the Y axis, and vice versa. The extraordinary season in 2016 saw the EYCI rise above the trend line, with restocker demand holding the spread at more like the levels seen during the years when BSE locked US beef out of Japan and Korea.

The weaker EYCI relative to the 90CL during the second half of 2017 saw the 90CL/EYCI spread at close to zero, slightly below the 16¢ that the trendline predicts with the annual slaughter of 7.16 million head.

Figure 1 also shows Meat and Livestock Australia’s projection for cattle slaughter in 2018, along with the 90CL/EYCI spread for the year to date. Cattle slaughter is running a bit ahead of MLA’s schedule, which accounts for some of the larger than expected spread, but weak restocker demand is also depressing the EYCI.

What does it mean/next week?:

While the Bureau of Meteorology increased the chance of El Nino to 50%, it still leaves at least a 50% chance of getting rain in the spring, or early summer. With rain, comes restocker demand, and weakening supply of store cattle and higher prices. The question of how much higher is limited by export prices, but under current values, a return to zero spread would see the EYCI gain 90¢ (Figure 2).

With the herd rebuild being put on hold, and maybe some more liquidation taking place, total cattle slaughter is likely to fall, meaning the EYCI could again move to a premium to the 90CL and take prices back towards 600¢.