Do we have a break?

The rain is falling, and prices are being dragged down in sync. In this update we take a look at the impact on ASX pricing and provide a short case study of a producer utilizing the contract to increase their pricing for the 2019/20 harvest.

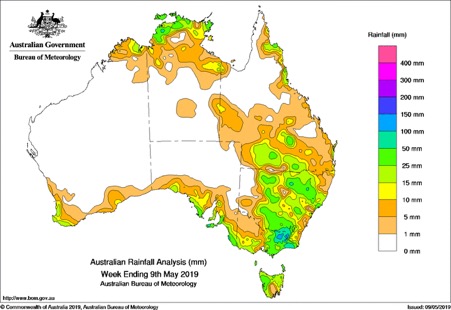

It’s good to hear the rain on the roof this morning, helping provide some surety to local growers in Victoria. In the past week we have seen beneficial falls in large parts of NSW and Victoria, which although will not guarantee a crop, it does give some breathing room.

In April, domestic consumers, especially buyers, were concerned about the lack of rainfall, and were buying ASX contracts in order to protect from a second year of drought. This caused a spike in prices up to A$340, the rainfall has removed that imperative.

Since just before the rain the market has fallen to A$304, and with today’s falls has a reasonable change of dropping below A$300.

In figure 1, CBOT for Dec’19 is displayed alongside ASX for Jan’20. Prices have fallen considerably for both markets since the 3rd quarter of last year. The positive outlook for the world production and political issues have pressured pricing and low levels are likely to persist.

The Food and Agriculture Organization released updated production forecasts this week, which are generally bearish. They expect world production to increase by 5% to 767mmt, causing ending stocks to rise approximately 10mmt to 27mmt.

We have been warning that the premium between CBOT and ASX would erode if rainfall arrived and the market moves back to an export focus. We proposed in September that taking some futures cover at levels >A$365 had a high likelihood of providing a financial benefit.

I discussed with a grower this week who utilized this strategy. They sold wheat at A$370, believing it to be a strong price historically, especially so far from the point of physical delivery. They have now calculated that if they closed their futures position that approximately A$20p/t will be added to their overall grain price.

This makes a good case for the benefits of utilizing derivatives as part of a wider grain price risk management strategy.

What does it mean/next week?:

For many consumers the ASX now provides attractive buying opportunities, however I expect many will have reached the limits of their capacity and risk policies.

The WASDE is released overnight – will it provide any surprises?