Don’t get caught in the basis bubble.

Shocking production brings sensational prices. During the past six months grain producers have been dejected by production or elated by prices. As we move into seeding it is important to understand that Australian prices are held up by a bubble of basis. Will the bubble burst?

Australian wheat prices in all zones are at very attractive levels. It is important not to be too distracted by these prices as we move into the new growing season. Our prices in a typical year are dominated by the export market, this year domestic deficits ruled the state of play.

The most important factor to remember in marketing in grain is basis. This is not a complicated term, it is merely the difference (premium or discount) between two pricing points. In most discussions around wheat we refence basis between the physical and Chicago futures price. However, it could just as easily be the basis between our price and London feed wheat futures.

The reason I used the term bubble in this article, is that the basis levels currently experienced will only be maintained if we see major production issues in the coming season. If we receive an average to above average crop, our prices will again be weighted towards exports.

Therefore, it is extremely important to look at both local and overseas levels, especially as we move closer into the planting window.

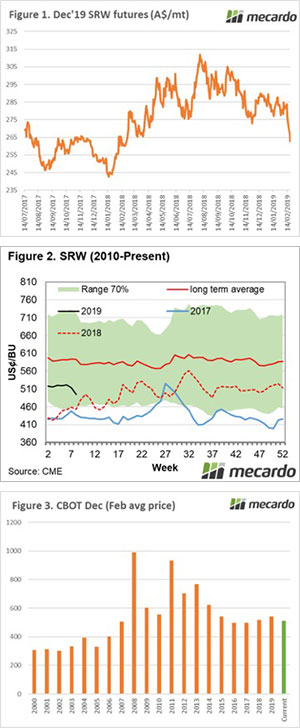

The futures market has received a beating during the past week with spot futures back 8% since the start of the month. This equates to A$19, a considerable fall in anyone’s books (figure 1). At a seasonal point of view the market is largely following the expected trend albeit more sharply than normal (figure 2).

In figure 3, the average February price for the following December is displayed, along with the current price (green bar). At present the current average for February is highest since 2014, however with another week to go, we could see this slip further.

So why are global prices falling?

- Demand from North Africa is declining

- US wheat is uncompetitive versus other origins (Argentina & Russia)

- Initial reports are positive for the coming crop in a number of origins

What does it mean/next week?:

It’s not all doom and gloom yet, there is still a long way to go between now and harvest. However, it is vitally important to understand the risk in the market.

Currently Australian producers can extract very strong prices as a virtue of our domestic deficit on the east coast.

These premiums over international values will not be sustained if we have a reasonable crop next season. Therefore, our prices will have to reduce to meet international demand, if we see global values fall, our levels will come in line.

At present producers on the east coast are able to access the ASX Jan 2020 contract at A$335, a basis level of A$72.

Key Points

- Basis levels in Australia are at historically high levels.

- Overseas values are under pressure.

- The basis levels experienced in Australia at present will not persist unless there is a 2nd disastrous year.