Easy tiger – Grass Fever

Key points:

After a few discussions this week with producers excited about the latest BOM rainfall forecast I thought it prudent to issue a bit of a cautionary note. As outlined in my comment last fortnight US beef markets are in a free fall and keen restockers need to take note of this offshore situation as grass fever now may cause a Corona inspired hangover next season.

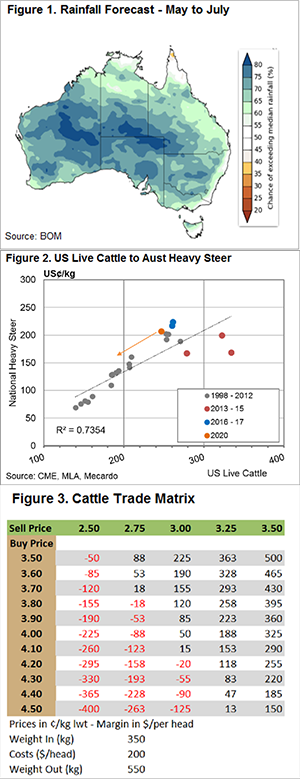

Late last week the Bureau of Meteorology issued a great looking three-month rainfall outlook showing 60-75% chance of exceeding the median rainfall across much of the country thanks to warm waters in the Indian Ocean pushing moisture across the continent – Figure 1.

In the last week, I have talked to many keen producers with available feed they haven’t seen in a while considering what is the best cattle trade to put on. Despite offshore beef market uncertainty and the prospect of a deep global recession, it seems grass fever is beginning to take hold.

Since the start of January US Live cattle futures have declined 30% falling from 275 US¢/kg to trade under 190US¢/kg this week as processor shutdowns due to Coronavirus infection at a number of plants in the US have created a backlog of cattle. Lockdown restrictions have seen demand for beef ease significantly from the food service sector.

Despite the tight supply situation and improved seasonal outlook, the Australian cattle market can’t sit in its own isolation for long. The extreme selloff in US prices will create headwinds for Australian prices if the US market cannot rebound in the next few months.

Figure 2 highlights the annual price correlation between US Live cattle futures prices and the National Heavy Steer. Drought in Australia can cause the normal discount that exists between US and Aussie prices to widen, as it did in 2013-15 when we traded well below the line of best fit (dotted line on Figure 2). Similarly, wetter periods or tight domestic supply can see the discount narrow to par (like now) or even head into a premium, like in 2016-17.

However, over the longer-term cattle prices in Australia will revert towards the normal relationship to the US and gravitate back towards the line of best fit. The longer US Live cattle futures remain under 200US¢/kg the more likely the local price of Heavy Steers is going to ease. The most likely path in a scenario of continued weak US prices is to see the 2020-point drift to the left as outlined by the orange arrow in Figure 2.

What does it mean/next week?’

This means that if US prices stay depressed, we could see the National Heavy Steer move towards 175US¢/kg lwt (around 275AU¢/kg based on an Aussie dollar of 63.5US¢). Last month I presented on restocker markets for a Holmes & Sackett/MLA webinar where we released a grass-fed cattle trade matrix showing the theoretical payoff based on a 350kg purchase and a 550kg sale weight – Figure 3.

COVID-19 hadn’t impacted US beef prices fully at that stage and the A$ was being sold off aggressively which was insulating us from the weaker US cattle price moves. This meant that the annual average Heavy Steer forecast for 2021 was still sitting comfortably in the 325-350¢/kg lwt range and restockers could pay in excess of 420¢ lwt for cattle and still make a comfortable margin according to the matrix.

However, the A$ has now rebounded and if US prices stay sub 200US¢/kg for an extended period this could see the forecast for Australian Heavy Steers in 2021 move closer to the 275¢ region which means that the margins restocker were hoping for could evaporate quickly – to the keen restockers out there… easy tiger!