ESTLI hits 900¢ but mutton has halted

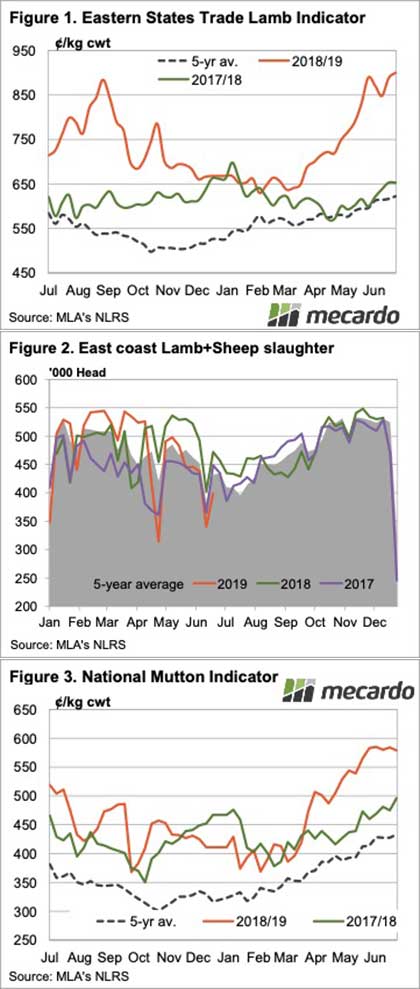

The lamb rally continued this week, as supplies continued to tighten. The Eastern States Trade Lamb Indicator (ESTLI) set a new record, just hitting 900¢. Mutton markets might have hit their peak, however, having come off in recent weeks.

After a brief dip there a few weeks back, which could have been in anticipation of a short week, the ESTLI price rally has made its way to 900¢/kg cwt. The ESTLI was up 15¢ this week, and interestingly, just 12¢ higher than four weeks ago. Current levels look like they are providing some resistance.

Tightening supplies are no doubt sending prices higher. Over the last two years there have been periods where lamb supplies have been tight, and sheep have been tight. It has been almost exactly two months since ovine slaughter has hit this level in a full week (figure 2).

Last week total sheep and lamb slaughter was 15% lower than last year, and 7.6% below the five year average. It didn’t get this low at all during the price peaks last year, and it is still only June.

Figure 3 shows the National Mutton Indicator seems to have found its peak. Sheep supply is tight, but is around the five year average, and it looks like processors are finished bidding up prices to try and draw out supply.

Mutton prices generally trend down in July, but it will be hard for that to happen again this year, as surely supply will remain tight for a while yet.

What does it mean/next week?:

For sheep and lamb prices to fall, either demand will have to weaken, or supply improve. Traditionally lamb and sheep supply will fall for another couple of weeks, before starting to recover. Last year the lamb supply didn’t come until August, so we may have a while to wait before we see prices ease.