High northern throughput has little impact.

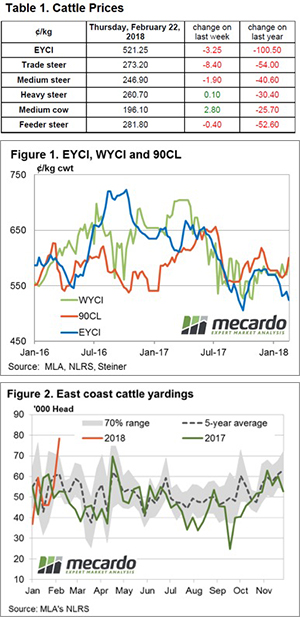

A surge in cattle yardings in Queensland and NSW this week failed to make a huge impact upon prices with markets ending the week fairly mixed. The Eastern Young Cattle Indicator (EYCI) only marginally softer, down a mere 3.25¢ to close at 521.25¢/kg cwt.

Table 1 highlights the mixed fortunes for the week, with lighter East coast steer categories mirroring the EYCI, posting marginal falls. East coast Trade Steers were the weakest, off 3% to close at 273.2¢/kg lwt. In contrast, East coast steers remained reasonably flat at 260.7¢, while Medium cows managed to lift 1.4% to 196.1¢/kg lwt.

Medium cows managed to lift 1.4% to 196.1¢/kg lwt.

In the West, young cattle were given a bit of a shake up, dropping 3% to 574¢/kg cwt, although still sitting relatively comfortable running 10% higher than Eastern states young cattle. In offshore markets, the 90CL frozen cow was steady above 600¢/kg – Figure 1.

Figure 2 demonstrates the surge in East coast cattle throughput on the week with a 42% gain recorded to just of 78,000 head. This pushes weekly yarding levels to well outside the normal variation than can be expected for this time in the season, and places it 28% higher than the five-year seasonal average.

The surge in East coast yarding levels this week was supported by increased throughput in Queensland and NSW. Indeed, Queensland cattle yardings of over 32,500 head represent a doubling of the numbers seen at the saleyards last week and NSW posted a 26% lift in numbers to over 31,600 head.

What does it mean/next week?:

Compared to the five-year seasonal average throughput pattern, the Queensland yarding figures posted this week are 73% higher, while the NSW throughput is elevated by 30%. It’s likely that this elevated yarding is a reaction to the muted wet season, although there was some reasonable rainfall recorded along the Eastern regions of both NSW and Queensland this week.

Given the increased numbers at the sale yard, it’s a reasonably good sign that prices didn’t soften too much across the East coast, a signal that demand is robust enough to soak up the added volume. More rain is forecast for much of the north east of the nation this week and this could see throughput levels return to more normal conditions, particularly in Queensland and NSW. If demand can be sustained, the reduced throughput could see cattle prices gain towards the end of February.