How volatile are wool prices?

As humans, we outweigh the reaction to losses more than the benefit of gains. So, it pays to look at longer-term data to test this emotional reaction, seeing whether it is grounded in reality or simply an emotional response. This article takes a look at the size of cyclical downturns in Merino wool, beef and wheat during the past two decades to put the recent fall in wool prices in a less emotional context.

The average Merino micron price is down AUD700 cents on mid-2018 levels. Peter Small, writing in Sheep Central recently, described a young wool grower asking about price stabilisation as an answer to recent falls in the wool price (view here). The question implied that the fall in wool prices during the past year has been unusual, but is it?

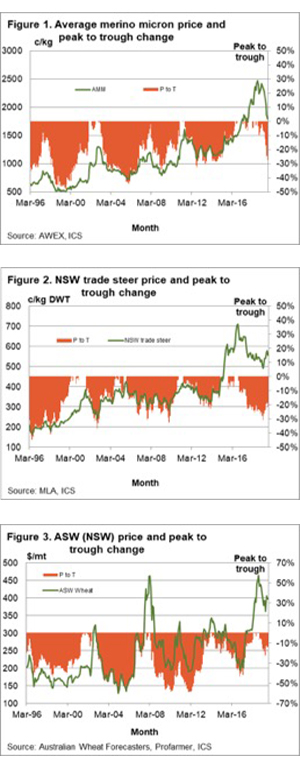

Figure 1 shows the monthly average for the average Merino micron price from 1996 to last month. It nearly touched 2500 cents in mid-2018, and is now around 1800 cents. It has certainly been a big fall in price, from a high level. Also shown in Figure 1 is the change in price from the highest price level of the previous five years. The idea is to look at the depth of the down cycles in terms of the proportion that prices fall from the peak to the trough (P to T). In the late 1990s, when many apparel fibre prices were depressed, the Merino price fell from 1997 peak levels by around 45%. It fell a similar proportion in 2005, down from the 2002-2003 peak. In 2009, the price only fell by 30-35%. In 2012 through 2015 the price fell from the 2011 peak by a more modest (again) 30%.

Currently, the market is 27% below 2018 peak levels, roughly on par with the 2012 downturn. The current downturn is therefore (so far) moderate and similar to the previous down cycle. The down cycles have become less severe in the past two decades, which makes sense as the level of stocks and production have fallen.

How does wool compare to beef? Figure 2 repeats the exercise for a NSW saleyard trade steer price. Since the 1990s down cycles have resulted in a fall of 25-30% from prior peak levels. The 2014 down cycle was appreciably smaller at around 20%.

Figure 3 treats a NSW wheat price series (Newcastle zone) in the same manner. Wheat shows up as more volatile, with some hefty down cycles where prices fell by 50%. There have been a couple of down cycles in the order of 30%, as well.

The take-home message from this very brief look at price volatility is that the average Merino wool price has comparable price volatility to beef and wheat. Down cycles do vary, but it is hard to make a case for the Merino price being in a league of its own in terms of price volatility.

What does this mean?

The average Merino price has fallen by around 700 cents since mid-2018. For those of us anchored in the 1990s that is a frightening number as it was once a (successfully) hedgeable price in its own right for 21 micron. In proportional terms though, the current downturn in wool prices looks to be playing out to it standard of the past decade. In comparison to trade steer and wheat, the wool market is not overly volatile – just a commodity price which goes through patches of strength and weakness.