Improved prices lift yarding, but not by much.

A 1.5% gain in the Eastern Young Cattle Indicator (EYCI) has encouraged a lift in yarding of young cattle, with the highest weekly throughput of EYCI eligible cattle recorded in fifteen weeks noted this week. Improved prices for most categories of East coast cattle saw the broader yarding figures lift too, but levels still remain below the normal range.

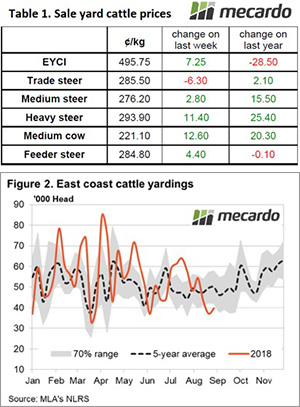

The weekly and yearly change in East coast saleyard cattle prices are highlighted in Table 1, which shows all bar Trade steers managed an improvement. On a yearly basis, it is only the EYCI eligible cattle that are underperforming in any significant manner despite the 7.25¢ gain achieved this week to close at 495.75¢/kg cwt.

Heavy steers and Medium cows continue to lead the pack, both in terms of weekly gains and their price level compared to the 2017 season. Medium cow managed a 6% gain to 221¢/kg and Heavy steers posted a 4% rise on the week to 294¢/kg lwt, with both categories sitting around 10% higher than this time last year.

The mid-month weather update from the Bureau of Meteorology (BOM) was released yesterday showing a continuation of the drier than normal rainfall pattern is expected for much of the country over October, although some parts of the Eastern seaboard are beginning to revert to a relatively normal October pattern. However, it’s not until November that the season starts to look more promising for much of the South Eastern quarter of the nation (Figure 1).

Improved prices across most cattle categories this week has prompted a 7% lift in East coast yardings to nearly 38,000 head. Despite this, increased throughput levels are still trending below the normal range for this time in the season and are around 20% below the seasonal five-year average for mid-September (Figure 2).

Next week

The rainfall outlook for next week returns to limited falls across most of the nation, except for coastal Victoria, so it’s unlikely to see any further rainfall inspired price gains. If the improved prices encourage further lifts in throughput back toward more normal seasonal levels, we could be in for a slight easing of prices as we head toward the last week of September. Particularly with the prospect of a drier than normal October just around the corner.