Kansas/Chicago – A spread trade strategy.

Key Points

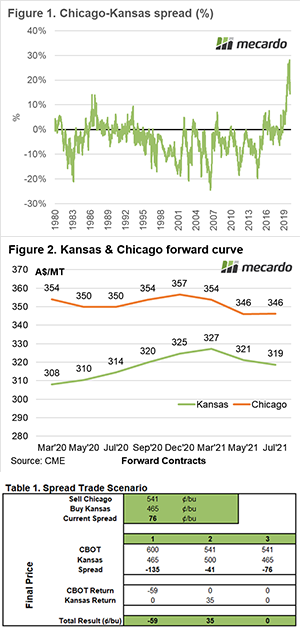

Kansas typically trades at a premium to Chicago. However, since 2018 Chicago has been running at a strong premium. In September we put forward a strategy for a spread trade to benefit from a mean reversal in values.

The two wheat contracts in the US are the Chicago soft red winter (SRW) wheat contract and the Kansas hard red winter (HRW) wheat contract. These are two distinct contracts with differing specifications, the SRW is low protein (9.5%) whereas the HRW is mid protein (11%).

Typically, Kansas would trade at a premium to Chicago wheat. However, the spread has changed to a strong Chicago premium over Kansas during 2018. During September the spreads reached highs of 28% over Kansas, and an average for the month of 22%. The market has since fallen to 15% (figure 1).

Those who followed this spread trade strategy have a return of 13%, not a bad return on investment in the current climate. However, the spread remains at 15% – still well above the long term average of -3%.

As China starts to ramp up purchases as part of their Phase 1 obligations and extra demand for milling wheat due to panic buying – there is still an opportunity for this spread to return to normal levels.

So as a refresher, here are some strategies on how to do this:

What simple trades can we do?

Long Kansas: It is possible to take out a straight futures contract for Kansas. In this scenario, we would purchase the Kansas futures contract for a forward period. In this scenario, we would be buying with the expectation of Kansas futures rising to meet Chicago.

There is however a risk that the Chicago contract could fall to meet Kansas, or worse that Kansas falls further.

Spread trade: If we only want exposure to the spread between the two contracts, we can trade both Chicago and Kanas.

Whilst buying Kansas, we would take an opposing contract by selling Chicago. If this trade was executed, there would be no interest in the underlying price, only the spread between the two contracts.

Here are few hypothetical scenarios of the end results (table 1):

- The spread increases: The trade will result in a loss.

- The spread returns to normal levels: The trade will result in a profit.

- The Spread remains the same: The trade will be neutral.

Remember to listen to the Commodity Conversation podcast by Mecardo

What does it mean/next week?:

This provides an opportunity to participate in further potential falls in the spread between Kansas and Chicago.

As with all strategies, there are risks involved. It is worthwhile getting advice from your risk management consultant.