More fake news and a spill in wheat

The week that was in wheat. There is always something interesting happening in the wheat market and when there isn’t, the industry can just make things up. In this week’s market comment, we provide some insights into fake news, futures pricing, local basis & the drop in barley pricing in WA.

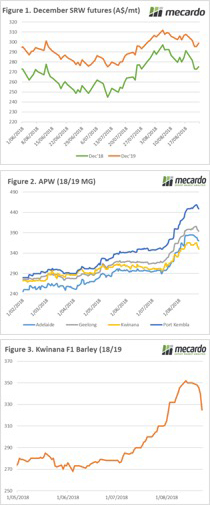

The futures market lost its leadership this week when futures prices fell, albeit only to late July levels (Figure 1). The recent fall is largely attributed to the increasing corn yields in the US and the expected reduced feed consumption of wheat. I wrote about this potential issue in early July, as the wheat to corn ratio started to rise (see here).

The futures market lost its leadership this week when futures prices fell, albeit only to late July levels (Figure 1). The recent fall is largely attributed to the increasing corn yields in the US and the expected reduced feed consumption of wheat. I wrote about this potential issue in early July, as the wheat to corn ratio started to rise (see here).

There were rumours towards the end of last week of Russia enacting an export ban, which pushed up prices, at least momentarily. This was, however, another example of ‘fake news’, in a similar fashion to the rise in early August as a result of misinterpreted social media postings by a Ukrainian minister (see here).

A Russian export ban is not going to be legislated this year, it is important to keep perspective on the fact that Russia is still on track to produce its 3rd largest wheat crop. If Russia takes action to limit exports, it will be in the form of export tariffs.

These fake news incidents further highlight the importance of high quality information in the agricultural sphere. it is extremely important to ensure that you are getting information that is of high calibre, timely (but not at the expense of accuracy) and free from bias & interference.

The local market lost some fire over the week, with basis level across all zones falling (Figure 2). The smallest fall was in Port Kembla (-1%), which makes sense due to the norths dire need for feed. All other zones fell by 2-5%. There is rainfall on the horizon in NNSW, which has pressured the ASX contract. There are some anonymous commentators (see here) calling now for a rise in wheat production up 25mmt.

My view from discussions with farmers and agronomists in the region is that it is a case of being too late to make any substantive change. It will however, provide some valuable soil moisture for the coming summer crop.

The barley market in WA has been interesting this week, with prices dropping considerably. The kwinana zone has seen F1 feed prices drop by $25/mt or 7% since last Friday (Figure 3). It has to be noted that although the price has fallen considerably, it would still be considered a very strong price from a historical perspective.

What does it mean/next week?:

It will be interesting to see what happens to wheat during the next week. The market has fallen sharply, but aside from lower feed usage the picture is still pointing towards a bullish pricing scenario.

The Russian crop is going to win the war of exports over the next six months, however we are likely to see a switch back to the US in the early part of 2019.