No joy for lotfeeders, or their suppliers

Grainfed cattle prices have fallen in line with the rest of the market, with the consistent decline putting pressure on lotfeeder margins. With pressure on lotfeeder margins comes lower feeder cattle prices, although, on a relative scale, they are performing ok.

Grainfed cattle prices have fallen in line with the rest of the market, with the consistent decline putting pressure on lotfeeder margins. With pressure on lotfeeder margins comes lower feeder cattle prices, although, on a relative scale, they are performing ok.

The Queensland Over the Hooks 100 day Grainfed Cattle indicator continued to ease last week. Grainfed cattle prices are now at two year lows, sitting at 513¢/kg cwt. This is the culmination of a 10% decline since mid-June, with the indicator now sitting at a 14% discount to the same time last year.

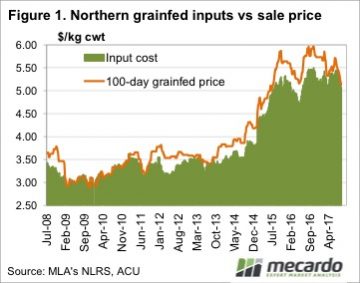

Figure 1 shows that grainfed cattle input costs, being feeder cattle and grain prices, have also been on the decline over the last two months. Input costs are not, however, sitting at a two year low, in fact they are not sitting far from the Grainfed cattle price, at 507¢/kg cwt.

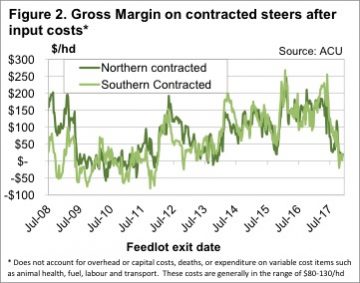

Obviously this means lotfeeder margins are on the squeeze, as input costs approach selling costs. Figure 2 shows that feeder steers bought last week, and contracted at the current price, will return just $20 in both northern and southern regions. After overheads most lotfeeders are likely to be making a loss, but things are not as bad as during the high grain price days of 2009-2011.

The situation is a bit different now, compared to 2009-2011. Back then cattle on feed numbers were low, with cattle going through feedlots at break-even to keep the doors open. Currently there are plenty of cattle on feed, and we have seen over the past couple of years that weak margins don’t last long.

The situation is a bit different now, compared to 2009-2011. Back then cattle on feed numbers were low, with cattle going through feedlots at break-even to keep the doors open. Currently there are plenty of cattle on feed, and we have seen over the past couple of years that weak margins don’t last long.

Having record numbers of cattle on feed is part of the problem, as strong numbers exiting feedlots is partly responsible for pushing the price of finished cattle down.

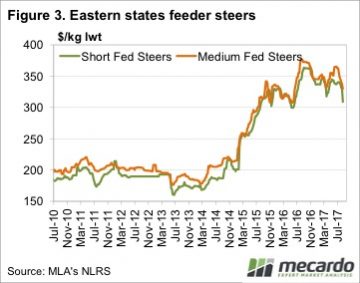

Interestingly input costs are basically the same in northern and southern markets, but feeder and grain prices differ. In the north sorghum and feed cereals are priced in the $280-300/t range, while in the south feed barley is at $210-230/t. By contrast, feeder cattle in the south are cheaper, with the Medium-fed paddock feeder at 330¢/kg lwt, while the short fed feeder, more common in the north, is costing 309¢/kg lwt.

Key points:

- Grainfed cattle prices have been on the decline, losing 10% over the last two months.

- Lotfeeder margins are currently low, and likely to result in fewer cattle on feed this quarter.

- When feeder cattle supply improves in the spring, prices could fall a further 20¢/kg lwt.

What does this mean?

It’s not unusual to see tight feeder cattle supply causing low lotfeeder margins at this time of year. The question is what happen when supply improves in September and October. Under current grainfed cattle and grain prices, feeder prices will have to fall 20¢/kg lwt for lotfeeder margins to improve back to $100/head. Figure 2 shows that $100/head is more in line with recent history.

It’s not unusual to see tight feeder cattle supply causing low lotfeeder margins at this time of year. The question is what happen when supply improves in September and October. Under current grainfed cattle and grain prices, feeder prices will have to fall 20¢/kg lwt for lotfeeder margins to improve back to $100/head. Figure 2 shows that $100/head is more in line with recent history.

Alternatively the grainfed cattle price could rise 25¢/kg cwt, which would also restore margins to $100/head at current feeder cattle values. This is not out of the question if the number of cattle on feed has declined.