Non-mulesed effect at the enterprise level for Merino flocks

A Mecardo reader, after reading about non-mulesed premiums for wool, asked about the effect of selling non-mulesed Merino store stock. His experience was that store stock buyers preferred mulesed Merinos, for the labour-saving reasons mulesing was first introduced. The implication was that such a preference led to discounts for non-mulesed Merino sheep sold to farmers.

To treat this topic in full is beyond the scope of a 450-word article, especially given our inability to source sales data about the mules/non-mules effect on store Merino prices from the industry. Farm production has a good record of responding to relative prices/costs so if there is a dollar involved, reported officially or not, farmer behaviour will adjust accordingly.

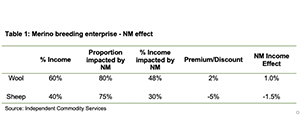

Holmes Sackett say 60-80% of Merino breeding enterprise income comes from wool. NSW DPI gross margins (2018) have an 18 micron flock receiving 60% of income from wool and a 20 micron flock 55%. For the sake of this article, we will assume a 60% share of income for wool.

AWEX publish weekly premium and discount schedules for the greasy market by region. Last week AWEX estimated non-mulesed premiums for 18 micron fleece at 2.1%, 19 at 2.2% and 20 micron 1.7%. Keep in mind these premiums vary. In a Merino clip, fleece accounts for around 80-85% of income. For the sake of the article we will assume 82% of the wool income (from fleece) is achieving a 2% premium for being non-mulesed, and the balance of the clip (pieces, bellies, and cardings are not affected).

It is worth pointing out that accreditation as non-mulesed has other potential benefits not captured by the auction data, such as access to forward/direct sales seeking to secure a supply of non-mulesed wool.

On the sheep side of the calculations, given the lack of reported sales data we had to resort to anecdotal reports. In talking to various farmers who have bought and sold Merino sheep, the general feedback is that non-mulesed sheep are discounted but the discounts vary according to the type of sheep and method of sale. One grower who had bought a lot of sheep on the basis of low cost found he ended up with a high proportion of non-mulesed stock. Another grower who sells sheep out of the Riverina to northern Victoria was told point-blank by repeat buyers that they would not buy his sheep if not mulesed (after only tail stripping them in 2019 because of seasonal conditions).

Let’s assume some 40% of income comes from sheep sales. The NSW DPI gross margin shows that about 25% of sheep income is from old sheep usually destined for slaughter, so the assumption is that only three-quarters of the 40% sheep income will be affected by the lack of mulesing.

What level of price effect does a lack of mulesing have on the price of young Merino sheep being sold to farmers? Firstly, this effect will vary. Secondly, in the absence of data, a five percent discount has been put in Table 1 as a start to look at the effect of NM across the Merino enterprise. Mecardo is happy to be persuaded the price effect should be otherwise, by data.

Table 1 is a simple model to sum up the enterprise effect of NM through its impact on wool and sheep sales. Given the assumptions used in Table 1 the enterprise income discount for NM young sheep sold is 1.5% compared to a premium of 1% picked up for the wool income. The net effect is a drop in income of 0.5%. The reality is likely to be that there is a distribution (range) in the net effect.

What does this mean?

This article shows that discounts for non-mulesed sheep sold as stores to farmers may offset any (average) premiums made of wool sold at auction. Farmer feedback indicates a range of discounts exists so in some cases the sheep NM discount will well and truly outweigh the wool price premium. Despite a lack of formal analysis, farmers will be incorporating these price effects into their decision making with regards to mulesing.