Rush to offload eases amid supply chain uncertainty

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

In an environment of limited price data and scant access to sheep/lamb indicators we are used to there is still the ability to see what is going on with throughput volume and slaughter. Producers respond to lower prices with a reduced offering at sale yards and meat works reluctant to increase their appetite as supply chains slow and export markets pause for Covid19.

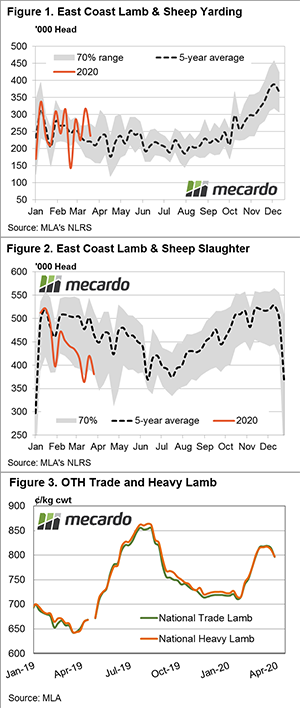

East coast lamb and sheep yarding levels have eased in recent weeks as the rush to offload stock amidst the Covid19 uncertainty abates and prices continue to drift lower. Weekly lamb yarding dropped nearly 30%, while mutton yarding dipped 15% to see combined throughput finish just under 240,000 head.

Compared to the week prior the lamb and sheep is off 25% to rest 7% above the five-year trend for this time in the season – Figure 1. The Easter break often sees ovine throughput reach a seasonal trough during April so the downward trajectory in sale yard volumes is to be expected.

After a short blip up in east coast lamb and sheep slaughter volumes during mid-March weekly levels returned back to the lower end of the seasonal range with the combined lamb/sheep slaughter figures dropping 9% to finish near 380,000 head – Figure 2.

Lamb exporters have been finding it difficult to find cargo space on passenger flights heading overseas as airline traffic grounds to a halt and the supply chain backlog suggests processors are hesitant to increase slaughter activity.

MLA reported just over 20% of chilled lamb exports made its way overseas as air freight in 2019 (measured on a value basis) so it is not an insignificant amount that needs to be transported. Hopefully, the federal government’s announcement of a $170 million rescue package for delivery of export produce to our key export markets will provide the capacity to get sheep meat exports moving again.

What does it mean/next week?:

The continued uncertainty over export demand and supply chain issues saw OTH indicators replicate the sale yards this week as OTH trade lamb prices softened 3% to close at 788¢/kg cwt. OTH Heavy lamb followed the weakening trend too, shedding 2% to rest at 797¢/kg cwt – Figure 3.

It is hard to see lamb and sheep prices bucking the trend for a downward bias in the week leading up to the Easter break, particularly while the spectre of Covid19 looms over offshore sheepmeat demand and continues to play havoc with the export supply chain.